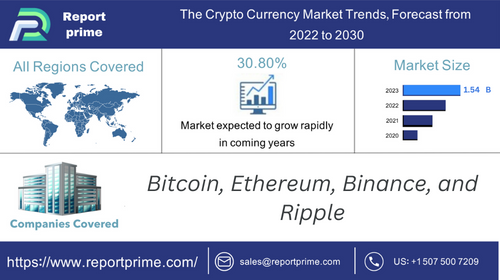

Crypto Currency Market size growing with a CAGR of 30.80%: Growth Outlook from 2022 to 2030, projecting market trends analysis by Application, Regional Outlook, and Revenue

The Crypto Currency Market is expected to grow from USD 1.54 Billion in 2022 to USD 13.17 Billion by 2030, at a CAGR of 30.80% during the forecast period. | Source:PRIMEIQ RESEARCH (OPC) PRIVATE LIMITED

New York, Dec. 19, 2023 (GLOBE NEWSWIRE) —

Market Overview and Report Coverage

The global crypto currency market research reports indicate that the market is experiencing significant growth due to increasing adoption and awareness among individuals and businesses. The market conditions for cryptocurrencies are highly volatile, with frequent fluctuations in prices and regulatory challenges. However, the market size is expected to witness substantial expansion over the forecast period. Key factors driving this growth include technological advancements, increasing investment, and growing acceptance of cryptocurrencies as a medium of exchange.

The objective of report is to define, segment, and project the market on the basis of product type, application, and region, and to describe the content about the factors influencing market dynamics, policy, economic, technology and market entry etc.

Cryptocurrency is a type of digital or virtual currency that utilizes cryptography for secure financial transactions, control the creation of new units, and verify asset transfers. The cryptocurrency market can be segmented based on type, including Bitcoin, Litecoin, Etherium, Zcash, and others. It can also be classified by application, such as private use, enterprise adoption, government implementation, and other purposes. Geographically, the market can be divided into North America, Asia Pacific, Middle East, Africa, Australia, and Europe. Some of the key market players in the cryptocurrency industry include Bitfinex, BitFury Group, Bitstamp, Coinbase, Coinsecure, Litecoin, OKEX Fintech Company, Poloniex, Ripple, Unocoin Technologies Private, and ZEB IT Service. Regulatory and legal factors play a vital role in shaping the market conditions for cryptocurrency. Various countries have different regulations concerning cryptocurrencies, such as their legal status, taxation policies, anti-money laundering measures, and consumer protection laws. Compliance with these regulations is crucial for market players and can affect the adoption and growth of cryptocurrencies in different regions. Additionally, market conditions regarding regulation and legality can impact investor sentiment, market volatility, and overall market dynamics for cryptocurrencies.

Get a Sample PDF of the Report: https://www.reportprime.com/enquiry/sample-report/16267

Crypto Currency Market Trends and Market Analysis

Cryptocurrency is a form of digital or virtual currency that relies on cryptography for security and operates on decentralized networks, typically based on blockchain technology. Its target market is vast, attracting investors, tech enthusiasts, and those seeking decentralized financial alternatives. The future outlook for cryptocurrencies is optimistic, with potential to reshape traditional finance, facilitate cross-border transactions, and serve as a store of value.

Companies operating in the cryptocurrency market, including industry leaders like Bitcoin, Ethereum, Binance, and Ripple, have driven innovation and adoption. Bitcoin pioneered decentralized digital currency, Ethereum introduced smart contracts, Binance operates a prominent cryptocurrency exchange, and Ripple focuses on facilitating cross-border payments.

Recent trends in the cryptocurrency market include the rise of decentralized finance (DeFi) platforms, non-fungible tokens (NFTs) gaining popularity in digital art and collectibles, and increased institutional investment. However, challenges persist, such as regulatory uncertainties, security concerns, and environmental debates surrounding energy-intensive mining processes. Despite challenges, the cryptocurrency market continues to evolve, with ongoing technological advancements and a growing user base contributing to its dynamic landscape.

Inquire or Share Your Questions If Any Before the Purchasing This Report- https://www.reportprime.com/enquiry/pre-order/16267

Top Featured Companies Dominating the Global Crypto Currency Market

The crypto currency market is a highly competitive landscape with numerous companies vying for market share. Some of the prominent players in this space include Bitfinex, BitFury Group, Bitstamp, Coinbase, Coinsecure, Litecoin, OKEX Fintech Company, Poloniex, Ripple, Unocoin Technologies Private, and ZEB IT Service. These companies contribute to the growth of the cryptocurrency market in various ways.

Bitfinex is a cryptocurrency exchange platform that allows users to trade a wide range of digital assets. It offers advanced trading features and high liquidity, attracting both retail and institutional investors. BitFury Group is a blockchain technology company that provides hardware and software solutions for mining and securing cryptocurrencies. It has a strong focus on blockchain infrastructure and has contributed to the growth of Bitcoin’s network.

Bitstamp is another cryptocurrency exchange that has gained popularity among traders due to its user-friendly interface and secure trading environment. Coinbase is a well-known name in the crypto sphere, offering a platform for buying, selling, and storing cryptocurrencies. It has played a significant role in increasing the adoption of cryptocurrencies by making it more accessible to the masses.

Coinsecure is an Indian cryptocurrency exchange that aims to provide secure and seamless trading experience to its users. It has helped to grow the crypto currency market by catering to the Indian market’s specific needs and requirements. Litecoin is a peer-to-peer cryptocurrency that was created as a “lite” version of Bitcoin. It has gained traction due to its faster block generation time and lower transaction fees.

OKEX Fintech Company operates one of the largest cryptocurrency exchanges by trading volume worldwide. It offers a wide range of digital assets for trading and has a robust derivatives platform. Poloniex is a digital asset exchange that provides a diverse range of cryptocurrencies for trading. It has been instrumental in the growth of the altcoin market by offering a wide selection of digital assets.

In terms of sales revenue figures, Coinbase reported revenue of $1.14 billion in 2020. Bitstamp reportedly generated revenue of around $100 million in 2020.

In terms of Product Type, the Crypto Currency market is segmented into:

- Bitcoin

- Litecoin

- Etherium

- Zcash

- Other

There are several types of cryptocurrency that have gained popularity in recent years. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. It operates on a decentralized network, meaning it is not controlled by any central authority such as a government or bank. Bitcoin uses blockchain technology to securely record transactions, making it transparent and resistant to fraud. Its limited supply and increasing demand have contributed to its value increasing over time.

Litecoin is another type of cryptocurrency that was created in 2011. Similar to Bitcoin, Litecoin also operates on a decentralized network and uses blockchain technology. However, it has some differences in terms of transaction speed and mining algorithms. Litecoin has gained popularity due to its faster transaction confirmation time and lower transaction fees compared to Bitcoin.

Etherium, launched in 2015, is a cryptocurrency that also operates on a decentralized platform. However, its main focus is on facilitating smart contracts. Smart contracts are self-executing contracts with terms written directly into code. Etherium’s ability to support smart contracts has made it a popular choice for developers and companies looking to create decentralized applications.

Zcash, introduced in 2016, is a privacy-focused cryptocurrency. It allows users to transact privately by using advanced cryptographic techniques. Unlike Bitcoin, Zcash offers selective transparency where users have the option to disclose their transaction details.

Purchase this Report https://www.reportprime.com/checkout?id=16267&price=3590

In terms of Product Application, the Crypto Currency market is segmented into:

- Private

- Enterprise

- Government

- Other

Cryptocurrency has various applications across private, enterprise, government, and other sectors. In private applications, individuals can use cryptocurrencies as a store of value or for making fast, secure, and low-cost transactions. Additionally, cryptocurrencies provide privacy and control over personal financial data. In enterprise applications, businesses use cryptocurrencies for cross-border transactions, as they offer faster settlement times and reduce costs associated with intermediaries. Governments are exploring the use of cryptocurrencies for digital identity and payment systems, enhancing financial inclusion. Other applications include decentralized finance, where cryptocurrencies enable lending, borrowing, and investment without traditional intermediaries.

Crypto Currency Market Regional Synopsis

The cryptocurrency market exhibits dynamic growth across regions, with North America (NA), Europe, and Asia-Pacific (APAC) emerging as key contributors. North America, particularly the USA, dominates the market, driven by widespread adoption, regulatory clarity, and institutional interest. Europe follows closely, experiencing substantial growth with increased regulatory frameworks. In Asia-Pacific, China plays a pivotal role, fostering innovation and adoption. While specific market share percentages can vary, North America is expected to maintain a significant lead, with Europe and Asia-Pacific following suit. The USA, China, and European countries are anticipated to dominate, collectively comprising a substantial portion of the global cryptocurrency market. As of now, North America is expected to have a substantial market share, potentially representing around 30-40% of the global cryptocurrency market. Consequently, Asia could potentially have a significant market share, estimated to be around 40-50%. Europe’s market share is expected to be around 10-20% of the global cryptocurrency market. While their market share may be smaller individually, collectively, the rest of the world could account for around 10-20% of the global cryptocurrency market.

Reasons to Purchase the Crypto Currency Market Research Report:

- Comprehensive Market Analysis: Understand the dynamics, trends, and challenges of the cryptocurrency market.

- Accurate Market Size and Projections: Access precise data for informed decision-making and investment strategies.

- Competitive Landscape Insight: Identify key players, market share, and strategic positioning.

- Technology Trends Exploration: Stay updated on evolving blockchain and cryptocurrency technologies.

- Regulatory Landscape Awareness: Stay informed about regulatory developments influencing the cryptocurrency market.

- Investment Opportunity Discovery: Identify potential areas for investment or collaboration.

Purchase this Report https://www.reportprime.com/checkout?id=16267&price=3590

CONTACT: Krishna Sharma US:- +1 507 500 7209 Email:- sales@reportprime.com Website:- https://www.reportprime.com/