Singapore, Singapore–(Newsfile Corp. – May 20, 2022) – iZUMi Finance, the innovative multi-chain DeFi protocol that provides Liquidity as a Service (LaaS) on multi-chains, announced the launch of their next-generation Decentralized Exchange (DEX) iZiSwap on BNB Chain, with a news of $30M investment raised aiming to expand its ecosystem.

iZUMi Finance

To view an enhanced version of this graphic, please visit:

http://orders.newsfilecorp.com/files/8506/124746_ace134767426688c_001full.jpg

Incorporated with the Discretized-Liquidity-AMM model, it comes alongside the debut of iZUMi’s new, U.S. dollar-pegged, 100% collateral-backed bond iUSD.

iZUMi Raises $30M & Expands Ecosystem

Through the sale of Bond Vouchers and iUSD claims, iZUMi announced it has raised $30 million to support the early liquidity provision of iZiSwap’s launch. Ivy Ventures, Cobo, Mirana and other institutional investors contributed $20 million towards the raise.

There was demand from the community for iZUMi Bond Voucher, with $4 million BUSD worth of vouchers sold out in just 17 minutes during the raise, and an additional 5,000 BNB – equivalent to $2 million USD – selling out in just under three hours.

iZUMi Finance has held a new round of Bond Voucher sale to raise 2,500 WETH and 550,000 BIT to energize the liquidity providers of the BIT/ETH pool on Uniswap V3. Previously on May 8, BitDAO created their liquidity pool of BIT/ETH on Uniswap V3, with its liquidity service provided by iZUMi Finance.

New Features in iZiSwap

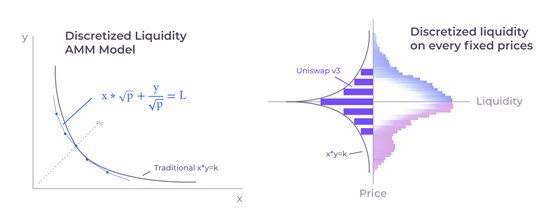

The introduction of iZUMi’s new Discretized-Liquidity-AMM will enable the rollout of a unique Limit Order feature in iZiSwap and cheaper trading fees.

The Discretized-Liquidity-AMM improves on the Concentrated Liquidity model that makes liquidity positions effective at certain price ranges. With DLAMM, iZiSwap is now able to cut these price ranges into discretized price ticks..

Mechanism of Discretized-Liquidity-AMM Model

To view an enhanced version of this graphic, please visit:

http://orders.newsfilecorp.com/files/8506/124746_ace134767426688c_003full.jpg

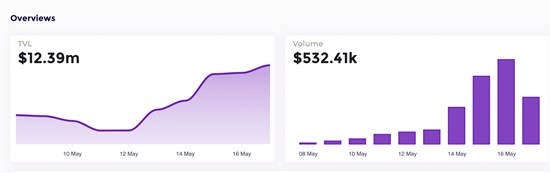

As of May 18, iZiSwap has successfully accumulated over $13M Total Value Locked (TVL) and generated over $500k trading volume in less than two weeks since its soft launch on May 7.

http://analytic.izumi.finance/Dashboard

To view an enhanced version of this graphic, please visit:

http://orders.newsfilecorp.com/files/8506/124746_ace134767426688c_004full.jpg

“Liquidity is the catalyst for growth in DeFi. With the launch of our Discretized-Liquidity AMM and iUSD, iZUMi Finance is eliminating the barriers to liquidity,” iZUMi Co-Founder Jimmy Yin said in a statement.

About iZUMi Finance

iZUMi Finance is a multi-chain DeFi protocol providing One-Stop Liquidity as a Service (LaaS). Its philosophy is that every token deserves a better on-chain liquidity in an efficient and lasting way. Deployed on Ethereum, BNB Chain, Polygon, and Arbitrum, iZUMi has provided liquidity services for BitDAO and 10+ protocols, and managed over $60M liquidity from reputable institutions and 8,000 individual LPs. The ultimate goal for iZUMi Finance is to help every partner and token to enjoy on-chain liquidity, continuous and long-lasting for centuries, like their name in Japanese signifies.

Contact Details:

Dan Edelstein

PR@marketacross.com

To view the source version of this press release, please visit http://www.newsfilecorp.com/release/124746

![]()