PARIS, March 15, 2022 /PRNewswire/ — Our 24th Art Market Report offers an analysis of global auction sales of fine art, including paintings, sculptures, drawings, photographs, print, videos, installations, tapestries – and NFTs – but excluding antiques, anonymous cultural property and furniture. It covers the period from 1 January 2021 to 31 December 2021.

All prices indicated in this report refer to public auction results including buyer’s fees. All references to $ refer to US dollars.

The the global art market’s performance in 2021 was unprecedented, putting the historic tragedy of the Covid 19 pandemic firmly behind it.

The market data shows a spectacular 60% increase in auction turnover in 2021 versus 2020, despite the continuation of the pandemic. The migration of the art market into the virtual sphere of the Internet is now a reality on all 5 continents, almost relegating the need for physical auction rooms to history.

Live online sales by Auction Houses increased 720% worldwide over the two years of the COVID pandemic. This level of growth was previously anticipated for 2025-2027.

Artprice by Artmarket is pleased to announce the publication of its 24th Global Art Market Report (2021), available free of charge, in full and in three languages, online as well as in PDF format:

English: http://imgpublic.artprice.com/pdf/the-art-market-in-2021.pdf

French: http://imgpublic.artprice.com/pdf/le-marche-de-lart-en-2021.pdf

Mandarin: http://imgpublic.artprice.com/pdf/zh-the-art-market-in-2021.pdf

Key market data for 2021:

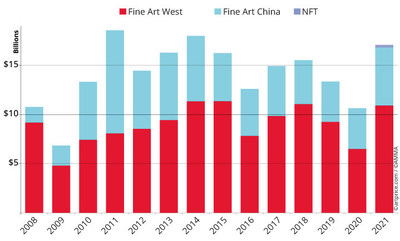

Global art auction turnover reached $17.08 billion, a 60% increase versus 2020.

Turnover from Fine Art sales in the West rose 68% to a total of $10.9 billion.

Revenue from Fine Art sales in China grew 43% to a total of $5.9 billion.

The number of lots exchanged in auctions worldwide reached an all-time record of 663,900 up 29%.

The average price of the lots sold was $25,730 and the median price was $930.

The unsold rate contracted to 31% thanks mainly to online sales.

The Contemporary Art index showed a +3% growth.

Contemporary Art accounted for 20% of the Art Market, compared to 3% in 2000.

Global turnover from fine art auctions

Infographic – http://104.196.70.3/wp-content/uploads/2022/03/Global_turnover_Infographic.jpg

Soft Power

With a total turnover of $5.95 billion (35% of the global total) China hammered more fine art auction proceeds than the USA with its total of $5.79 billion (34%).

With a total of $1.99 billion, the UK was 10% down versus the level it posted in 2019.

The top three national markets in the global art market accounted for 80% of global art auction turnover.

For the first time in its history, France’s annual total exceeded $1 billion at auction, at last becoming a major player in the global art market.

The German market secured 5th place in the global ranking and attracted Sotheby’s to Cologne.

South Korea multiplied its art auction turnover by four, generating $237 million.

China in first position

This report shows that China has once again reached the top position in the global national ranking in terms of art auction dynamism, very clearly demonstrating its ‘serious competitor’ status versus the United States. While China’s market has its own codes, this makes it all the more interesting and it is also why the editorial partnership between Artprice and Artron is both exciting and extremely relevant to the global reality of a rapidly changing market.

Top 10 countries by Fine Art & NFT auctions (evolution vs. 2020)

|

1. China (Artron): |

$ 5,953,355,500 (+43.0%) |

|

2. United States: |

$5,794,793,900 (+102.3%) |

|

3. United Kingdom: |

$1,996,657,600 (+28.6%) |

|

4. France: |

$1,008,464,700 (+71.8%) |

|

5. Germany: |

$356,967,400 (+18) |

|

6. South Korea: |

$237,290,600 (+369.90%) |

|

7. Italy: |

$212,554,100 (+49.1%) |

|

8. Switzerland: |

$193,884,700 (+74.7% ) |

|

9. Japan: |

$167,464,400 (+75.6%) |

|

10. Poland: |

$142,070,800 (+66.5%) |

Auction Houses

Sotheby’s and Christie’s hammer 49% of the global art auction market with $4.4 billion and $4 billion respectively.

Poly and China Guardian are quite a long way behind, with $824 million and $677 million.

Poly and Phillips teamed up in Hong Kong and hammered $175 million together.

Ketterer, with $97 million in 2021, was the leading Auction House in Continental Europe.

Artcurial, France’s leading auction house, sold 3,800 artworks for $91 million.

Artists and auctions

In 2021, one lot fetched over $100 million: Pablo Picasso’s Seated Woman (1932) at Christie’s New York.

In 1997, the same painting sold for $7.5 million.

In 2021, Picasso, Basquiat, Warhol, Richter and Zhang Daqian were the most successful artists at auction in the world.

Beeple was the most expensive living artist of the year, with a lot that fetched $69.4 million.

Gerhard Richter and Banksy are the world’s most successful living artists at auction.

Banksy totaled 1,186 works sold for $206 million, including a new record at $25.4 million.

Yayoi Kusama is the first woman in history to join Artprice’s Top 10 global artists by turnover.

Jean-Michel Basquiat became the 2nd most successful artist in the world, after Picasso.

For the first time, five major Basquiat works were sold in Hong Kong.

Major trends

1. NFTs offer a whole new way of collecting:

The results for works by Beeple, Pak, Larva Labs, Yuga Labs have made this new market unavoidable.

As soon as they arrived at auction, the 279 NFT lots totaled $232.4 million (more than the photography segment).

2. Young artists broke precocity records (the so-called “red-chip” phenomenon):

Beeple (40 years old), Avery Singer (34 years old), Fewocious (18 years old) reached eye-watering prices.

3. Demand for works by African artists and artists from the African diaspora showed tremendous vitality.

The Art Market 3.0: NFT, Metaverse and Blockchain

thierry Ehrmann, CEO and Founder of Artmarket.com and its Artprice department:

“Internet 2.0 made it possible to be on the Internet. Internet 3.0 is now happening in the Internet. During 2021, with COVID taking so many lives and completely dominating our daily lives and vocabulary, the famous Collins dictionary still considered the word “NFT” to be the most important “word of the year”. Highly controversial, the term is important not just for having been on everyone’s lips, but because it carries within it the seeds of a digital revolution that is impacting the art market in a way we haven’t seen in five centuries. That is why our 2021 Art Market Report begins with this term.”

To fully comprehend the historical impact of NFTs on the art world in 2021, we must go back to the Renaissance when a similar paradigm shift occurred. Thanks to Johannes Gutenberg’s printing house, artists were – for the first time – able to print their first editions. This represented a major transfer of power into the hands of artists.

This evolution allowed artists – for the first time in history – to generate income and to control their own production in their workshops and factories. Today with NFTs, we are experiencing a similar paradigm shift with the same historical importance.

The Metaverse is not about 3D or 2D. It is about the dematerialization of the physical state to a new world where once impossible experiences are now accessible.

During this 21st century of Enlightenment, the art world will be reconfigured around creation and the virtual (but very real) economy, finally providing the necessary support for a much larger population of creators.

Singularity remains the most beautiful signature, even in the virtual world of the Metaverse.

The dematerialization of the Art Market via the Internet took roughly 30 years. With the world of NFTs and the Metaverse, the internet is no longer just a transit vehicle for the Art Market… it is where the art itself will be created and exchanged. We are entering a totally new dimension.

Geographical distribution of Fine Art auction turnover in 2021

Infographic – http://104.196.70.3/wp-content/uploads/2022/03/Geographical_distribution.jpg

In short, despite being strongly impacted by the pandemic – an unprecedented global tragedy in the history of the modern economy – the art market has managed to rebound via the adoption of digital technology in record time. This shift has enabled exponential growth of +60%, despite the continuation of the pandemic more or less everywhere on the world’s five continents. In the West, this spectacular annual growth even reached +68%, a growth level not seen in 25 years.

Images :

[http://imgpublic.artprice.com/img/wp/sites/11/2022/03/image1-EN-Global-Auction-TUrnover_EN.jpg]

[http://imgpublic.artprice.com/img/wp/sites/11/2022/03/image2-EN-geographical-breakdown_EN.jpg]

Copyright 1987-2022 thierry Ehrmann www.artprice.com – www.artmarket.com

- Don’t hesitate to contact our Econometrics Department for your requirements regarding statistics and personalized studies: econometrics@artprice.com

- Try our services (free demo): http://www.artprice.com/demo

- Subscribe to our services: http://www.artprice.com/subscription

About Artmarket:

Artmarket.com is listed on Eurolist by Euronext Paris, SRD long only and Euroclear: 7478 – Bloomberg: PRC – Reuters: ARTF.

Discover Artmarket and its Artprice department on video: www.artprice.com/video

Artmarket and its Artprice department was founded in 1997 by its CEO, thierry Ehrmann. Artmarket and its Artprice department is controlled by Groupe Serveur, created in 1987.

See certified biography in Who’s who ©:

Biographie_thierry_Ehrmann_2022_WhosWhoInFrance.pdf

Artmarket is a global player in the Art Market with, among other structures, its Artprice department, world leader in the accumulation, management and exploitation of historical and current art market information in databanks containing over 30 million indices and auction results, covering more than 770,000 artists.

Artprice by Artmarket, the world leader in information on the art market, has set itself the ambition through its Global Standardized Marketplace to be the world’s leading Fine Art NFT platform.

Artprice Images® allows unlimited access to the largest Art Market image bank in the world: no less than 180 million digital images of photographs or engraved reproductions of artworks from 1700 to the present day, commented by our art historians.

Artmarket with its Artprice department accumulates data on a permanent basis from 6300 Auction Houses and produces key Art Market information for the main press and media agencies (7,200 publications). Its 5.4 million (‘members log in’+social media) users have access to ads posted by other members, a network that today represents the leading Global Standardized Marketplace® to buy and sell artworks at a fixed or bid price (auctions regulated by paragraphs 2 and 3 of Article L 321.3 of France’s Commercial Code).

Artmarket with its Artprice department, has been awarded the State label “Innovative Company” by the Public Investment Bank (BPI) (for the second time in November 2018 for a new period of 3 years) which is supporting the company in its project to consolidate its position as a global player in the market art.

Artprice by Artmarket’s 2020 Global Art Market Report published in March 2022:

http://www.artprice.com/artprice-reports/the-art-market-in-2021

Artprice’s 2020/21 Contemporary Art Market Report by Artmarket.com:

http://www.artprice.com/artprice-reports/the-contemporary-art-market-report-2021

Index of press releases posted by Artmarket with its Artprice department:

serveur.serveur.com/Press_Release/pressreleaseEN.htm

Follow all the Art Market news in real time with Artmarket and its Artprice department on Facebook and Twitter:

www.facebook.com/artpricedotcom/ (over 5,4 million followers)

Discover the alchemy and universe of Artmarket and its artprice department http://www.artprice.com/video headquartered at the famous Organe Contemporary Art Museum “The Abode of Chaos” (dixit The New York Times): http://issuu.com/demeureduchaos/docs/demeureduchaos-abodeofchaos-opus-ix-1999-2013

- L’Obs – The Museum of the Future: http://youtu.be/29LXBPJrs-o

- www.facebook.com/la.demeure.du.chaos.theabodeofchaos999 (4.4 million followers)

- http://vimeo.com/124643720

Contact Artmarket.com and its Artprice department – Contact: Thierry Ehrmann, ir@artmarket.com

Logo – http://104.196.70.3/wp-content/uploads/2022/03/Art_Market_logo-1.jpg

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/artmarketcom-releases-the-artprice-2021-global-art-market-report-showing-a-60-growth-in-turnover-and-a-paradigm-shift-marked-by-the-arrival-of-nfts-301502341.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/artmarketcom-releases-the-artprice-2021-global-art-market-report-showing-a-60-growth-in-turnover-and-a-paradigm-shift-marked-by-the-arrival-of-nfts-301502341.html

SOURCE Artmarket.com

![]()