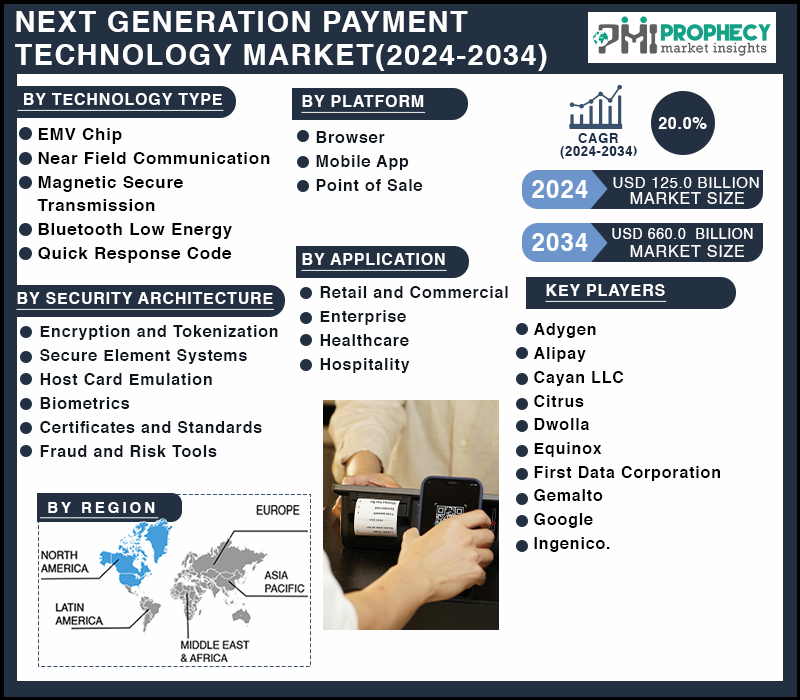

“Next Generation Payment Technology Market” from 2024-2034 with covered segments Type (EMV Chip, Near Field Communication, Magnetic Secure Transmission, Bluetooth Low Energy, and Quick Response Code), By Platform (Browser, Mobile App, and Point of Sale), By Security Architecture (Encryption and Tokenization, Secure Element Systems, Host Card Emulation, Biometrics, Certificates and Standards, and Fraud and Risk Tools), By Application (Retail and Commercial, Enterprise, Healthcare, and Hospitality), By Regional Forecast, (2024-2034), which provides the perfect mix of market strategies, and industrial expertise with new cutting-edge technology to give the best experience.

Covina, Aug. 01, 2024 (GLOBE NEWSWIRE) — According to Prophecy Market Insights, the global next generation payment technology market size and share is projected to grow from USD 125.0 Billion in 2024 to reach USD 660.0 Billion by 2034, exhibiting a compound annual growth rate (CAGR) of 20.0% during the forecast period (2024 – 2034).

Next Generation Payment Technology Market Report Overview

Next-generation payment technology is a new way of transmitting value, using mobile and digital technologies in the production of far easier, faster, and more secure transactions. Next-gen payments work on mobile devices, such as cell phones, as a means of payment, where electronic transactions are given precedence over their physical counterparts. Some of the prime characteristics include a digital-first approach, real-time processing, advanced security features, and ease of use. Examples may include tokenization, mobile wallets, biometric authentication, blockchain technology, cryptocurrencies, and contactless payments. Next-generation technologies have efficiency-oriented advantages, lower occurrences of fraud and data breaches, increased convenience, and new business opportunities. These technologies will alter how we pay by making transactions efficient, secure, and user-friendly.

The next-generation payment technology market is fast-growing, as it is focused on developing payment processing technologies offering easier and more secure transactions. It aims to come up with faster, more accurate, and more practical payment solutions by surmounting the challenges of security, authenticity, and latency. Hence, it is very fast-moving. In this regard, hardware suppliers, financial institutions, e-commerce enterprises, payment service providers, and technological companies will use products of payment technology to facilitate and speed up transactions. The market is growing due to an increased demand for legislation related to payment security, innovation by technological companies, and changes in the setting of payments. System security against any possible invaders, speed, and user-friendliness are the three major areas that exhort prime concern.

Download a Free Sample Research Report with Latest Industry Insights: https://www.prophecymarketinsights.com/market_insight/Insight/request-sample/4481

Our Free Sample Report includes:

- Overview & introduction of market study

- Revenue and CAGR of the market

- Drivers & Restrains factors of the market

- Major key players in the market

- Regional analysis of the market with a detailed graph

- Detailed segmentation in tabular form of market

- Recent developments/news of the market

- Opportunities & Challenges of the Market

Competitive Landscape:

The Next Generation Payment Technology Market is characterized by rapid growth, technological innovation, and fierce competition. Companies are expanding their global presence, focusing on sustainability, and diversifying their service offerings to stay competitive.

Some of the Key Market Players:

- Adygen

- Alipay

- Cayan LLC

- Citrus

- Dwolla

- Equinox

- First Data Corporation

- Gemalto

- Ingenico

To Know More on Additional Market Players, Download a Free Sample Report Here: https://www.prophecymarketinsights.com/market_insight/Insight/request-pdf/4481

Analyst View:

Next-generation payment technology is an upcoming industry that uses mobile and digital technologies in the transfer of value to provide efficiency, reduced fraud, and convenience. The disruption of cross-border payments through upcoming technologies like blockchain makes the process of making payments easy and lowers transaction fees. As such, businesses need to invest in high-end payment solutions powered by speed, security, and personalization. Market trends also include financial inclusion, where people can send and receive money, make payments, and access financial services through digital wallets and mobile money platforms. On the legal front, legal technology can improve the legal process in document management, research and analytics, practice management, legal collaboration, artificial intelligence, cybersecurity, data privacy, and so on. Security architecture is very important in ensuring the appropriate security of sensitive information and the systems of legal technology.

Market Dynamics:

Drivers:

Growth of Digital and E-Commerce

- In turn, the proliferation of mobile wallets and contactless payments brought about by smartphones realizes rapid and safe transactions. On the other hand, the proliferation of smartphones makes mobile wallets and contactless payments widespread, realizing rapid and safe transactions. Since consumers expect seamless payment journeys across multiple channels, one is prompted to make investments in integrated payment solutions. Recurring payment solutions that are safe, secure, capable of handling vast quantities of transactions, managing client subscriptions, and being compliant with various regulatory requirements shall be required with a subscription-based model. Emerging technologies, such as blockchain, are disrupting cross-border payments, impelled by global e-commerce. They facilitate the payment process and decrease transaction fees.

Changing Expectations of Customers

- The modern customer desires an easy way to pay however they want—via online, in-store, and mobile applications. More recently, the pace has been accelerated by Internet commerce, where customers now expect fast transactions and a simple checkout experience. The level of personalization cyber dangers have brought to customers is only going to increase in the future. As requirements alter, businesses need to invest in high-end payment solutions powered by the idea of speed, security, and personalization.

Request for a Discounted Price on this Report @ https://www.prophecymarketinsights.com/market_insight/Insight/request-discount/4481

Market Trends:

Monetary inclusion

- Next-generation payment technologies are financially inclusive, meaning the delivery of financial services to unserved or underserved communities in developing countries. People can send and receive money, make payments, or access financial services like loans and insurance through their mobile phones with digital wallets and mobile money platforms as key instruments of financial inclusion. This can spur economic growth and reduce poverty by the investment in enterprises, education of children, and accumulation of savings. Similarly, financial inclusion advances social development by enhancing the stability of finance and reducing inequality. This is for the simple reason that it raises public confidence in the financial system, very necessary for economic growth.

Segmentation:

Next Generation Payment Technology Market is segmented based on Technology Type, Platform, Security Architecture, Application, and Region.

Technology Type Insights

- Legal technology enhances the legal process in Document Management and Automation, Legal Research and Analytics, Practice Management, Legal Collaboration and Communication, Artificial Intelligence, Cybersecurity, and Data Privacy and Legal Process Automation. On this count, EDMS for document central storage, management of contracts with Contract Lifecycle Management, access to legal databases using Legal Research Platforms, and AI for contract analysis and eDiscovery are all prominent segments. These include Cybersecurity and Data Privacy, with Data Loss Prevention and Cybersecurity Solutions that protect sensitive legal data.

Platform Insights

- These legal technology platforms are software programs that allow a single location to organize and manage legal data, procedures, and teamwork. They can also be further segmented into practice management platforms, document management systems, legal research platforms, client portal platforms, and e-discovery platforms. Some of the benefits they bring about are cost reduction, improved service to the client, improved efficiency, improvement in collaboration, protection of data, and many others. They improve communication, speed up workflows, and automate repetitive operations, and are resource allocation with the highest possible efficiency.

Security Architecture Insights

- It is an important framework that ensures appropriate and adequate security of sensitive information and systems of legal technology. This involves creating, implementing, and enforcing security policies for information assets to be safe from threats. Some of these challenges include data volume, complexity, distant work, constantly changing dangers, and intricate compliance requirements. It means that law firms should do periodic security assessments, train staff, encrypt data, have incident response plans in place, and assess third-party risks. This includes regular penetration testing vulnerability assessments and security awareness training.

Application Insights

- Legal technology applications are software tools and online software platforms designed for use in the legal profession. Key areas of application include e-discovery, legal research, practice management, document management, contract management, compliance management, legal analytics, artificial intelligence, and machine learning. These areas often work in concert—and sometimes overlap—allowing a document management system interface with e-discovery technologies, permitting rapid discovery of ESI. Legal analytics can similarly be applied to e-discovery data extracted to develop deep data-driven insights.

Request a Customized Copy of Report @ https://www.prophecymarketinsights.com/market_insight/Insight/request-customization/4481

Recent Development:

- In July 2024, The future of UPI with exciting new use cases and through its international reach is promising. Mindgate Solutions Pvt. Ltd hosted its annual MindsKonnect event at JW Marriott, Mumbai, focusing on ‘Next-Generation Payments: Right Here, Right Now’. The event brought together industry leaders from India and the Middle East to discuss the role of technology in shaping the future of payments, Transaction Banking, and Real-Time Payments.

- In May 2024, Kickstarting the next generation of blockchain payments. Mastercard is introducing five global startups to its Start Path Blockchain and Digital Assets program, aiming to enhance user experiences and showcase the power of blockchain technology. The program aims to explore how people and businesses use money to move value and solve real-world problems, as blockchain and digital assets are transforming financial services and enhancing trust and transparency in commerce.

Regional Insights

- North America: North America, particularly the US, drives the new generation of payment technology. This could be founded based on its early adoption of digital technologies, robust infrastructure, consumer demand for convenience, competitive market, and strong regulatory environment. Some of the most important trends include mobile payments, digital wallets such as Apple Pay, Google Pay, and Samsung Pay, Buy Now and Pay Later services, cryptocurrency adoption, and real-time payments like The Clearing House’s RTP network. Even though security concerns and financial inclusion are contained within the view, the growth opportunities for North America lie in biometric authentication, tokenization, and cross-border payments.

- Asia Pacific: In addition to the growing middle class, internet connection, and smartphone usage across the Asia Pacific region, these trends will continue to shake up the business of payments. Within that are some of the larger trends at play: mobile-first strategies, real-time payments, e-commerce, financial inclusion, and central bank digital currencies. China dominates the world in mobile payments with services such as Alipay and WeChat Pay, while India’s UPI makes a turn in retail payments. Still, differences in infrastructure, cybersecurity threats, and regulatory complexity are all issues to be ironed out.

Browse Detail Report on “Next Generation Payment Technology Market, By Technology Type (EMV Chip, Near Field Communication, Magnetic Secure Transmission, Bluetooth Low Energy, and Quick Response Code), By Platform (Browser, Mobile App, and Point of Sale), By Security Architecture (Encryption and Tokenization, Secure Element Systems, Host Card Emulation, Biometrics, Certificates and Standards, and Fraud and Risk Tools), By Application (Retail and Commercial, Enterprise, Healthcare, and Hospitality), By Region– Market Trends, Analysis, and Forecast till 2034” with complete TOC @ https://www.prophecymarketinsights.com/market_insight/Global-Next-Generation-Payment-Technology-Market-4481

Browse More Research Reports:

- Carbonization Furnace Market Size & Share Research Report, 2024-2034

- Super Absorbent Polymer Market Size & Share Research Report, 2024-2034

- Iliac Stent Market Size & Share Research Report, 2024-2034

- Exosome Diagnostics and Therapeutics Market Size & Share Research Report, 2024-2034

- Medical Device Commercialization Services Market Size & Share Research Report, 2024-2034

About Us:

Prophecy Market Insights is a specialized market research, analytics, marketing, and business strategy, and solutions company that offers strategic and tactical support to clients for making well-informed business decisions and identifying and achieving high-value opportunities in the target business area. Also, we help our client to address business challenges and provide the best possible solutions to overcome them and transform their business.

Prophecy’s expertise area covers products, services, latest trends, developments, market growth factors, and challenges along with market forecasts in various business areas such as Healthcare, Pharmaceutical, Biotechnology, Information Technology (IT), Automotive, Industrial, Chemical, Agriculture, Food and Beverage, Energy, and Oil and Gas. We also offer various other services such as data mining, information management, and revenue enhancement suggestions.

Contact Us:

Prophecy Market Insights

US: 964 E. Badillo Street

#2042 Covina,

CA 91724

US toll-free: +1 860 531 2574

Rest of World: + 91 7775049802

Follow us on LinkedIn | Twitter

![]()