The continuous innovation in blockchain technology, smart contracts, and decentralized applications (dApps) is a primary driver. These technologies are fundamental to Web3, offering enhanced security, transparency, and decentralization compared to traditional web frameworks.

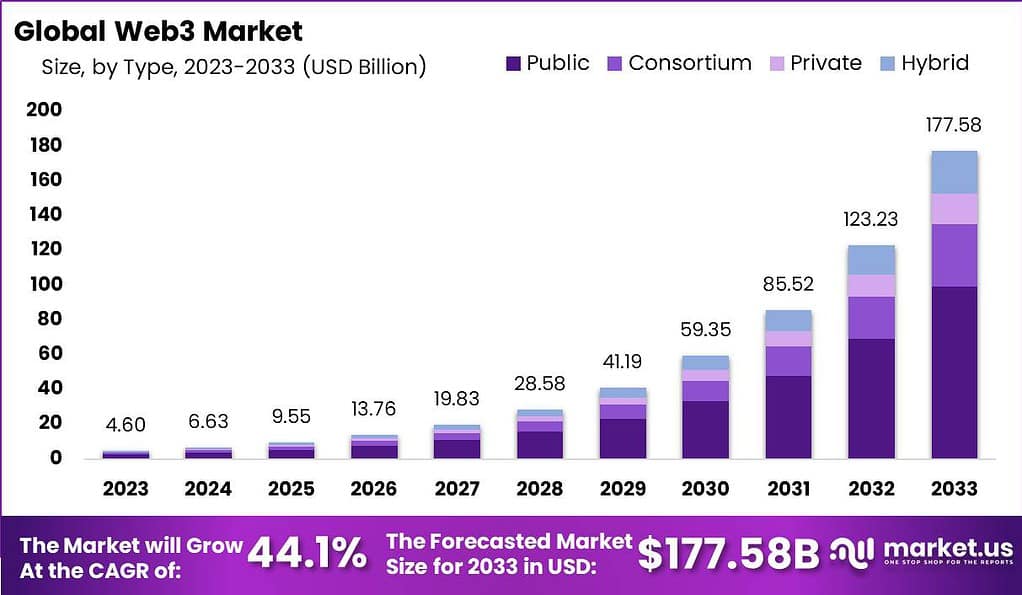

New York, Jan. 18, 2024 (GLOBE NEWSWIRE) — According to Market.us, The projected value of the global Web3 Market is anticipated to be USD 4.6 billion by 2023 and is expected to witness substantial growth, reaching USD 177.58 billion by 2033. The market is poised for a remarkable surge, with a projected Compound Annual Growth Rate (CAGR) of 44.1% during the forecast period from 2024 to 2033.

Web3 refers to the next generation of the internet, which aims to decentralize the control of data and enable peer-to-peer interactions through blockchain technology and decentralized protocols. Unlike Web 2.0, which relies on centralized platforms and intermediaries, Web3 puts individuals at the center, giving them greater control over their data and digital interactions. The emergence of Web3 has the potential to transform various industries, including finance, gaming, supply chain management, and social media.

The Web3 market is experiencing significant growth as more companies and developers embrace decentralized technologies and build applications on blockchain platforms. In the finance sector, decentralized finance (DeFi) protocols are revolutionizing traditional banking and financial services by enabling peer-to-peer lending, decentralized exchanges, and programmable money. DeFi has gained traction due to its promise of increased transparency, accessibility, and financial inclusion.

Get deeper insights into the market size, current market scenario, future growth opportunities, major growth driving factors, the latest trends, and much more. Buy the full report here

Analyst Viewpoint

The core driving forces behind this growth include an escalating demand for decentralization, heightened concerns over data privacy, and the progressive integration of blockchain technology across various sectors. The decentralization inherent in Web3 addresses critical issues of data ownership and control that are prevalent in the Web2 era, offering a more secure and user-centric internet experience.

Sequoia Capital’s $600 million fund dedicated to Web3 initiatives reflects a strategic positioning to capitalize on the next wave of internet evolution. This fund’s emphasis on startup innovation indicates a recognition of the need for continuous technological advancement. Tiger Global’s $250 million investment in Polygon (MATIC) demonstrates a growing institutional interest in blockchain scalability solutions, acknowledging the critical role of infrastructure in the widespread adoption of Web3 technologies.

In terms of opportunities, the Web3 market is brimming with potential. The financial sector, particularly with DeFi, stands out as a primary beneficiary. DeFi offers an alternative to traditional financial services, enabling activities like lending, borrowing, and insurance without the need for centralized institutions. This disruption in the financial sector not only democratizes access to financial services but also opens up avenues for innovation in financial products and services.

The growth in NFTs presents another significant opportunity, transcending the realms of art, gaming, and digital content, enabling new forms of digital ownership and monetization. Furthermore, the adoption of Web3 technologies in supply chain management can enhance transparency, traceability, and efficiency, providing a more robust and reliable system.

The report provides a full list of key companies, their strategies, and the latest developments. Download a PDF Sample before buying

Key Takeaways

- The Web3 Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 44.1% from 2024 to 2033, reaching a valuation of USD 177.58 billion by 2033.

- In 2023, the Public Segment dominated the Web3 market with over 56% market share, followed by Consortium and Private segments. The Hybrid Segment also showed potential for growth.

- Payments held a leading position in 2023 with more than 35% market share, followed by Cryptocurrency, Conversational AI, Data and Transaction Storage, and other applications.

- The BFSI sector led in 2023, with over 23% market share, followed by IT & Telecom, Media & Entertainment, E-commerce & Retail, Healthcare & Pharmaceuticals, and other industry verticals.

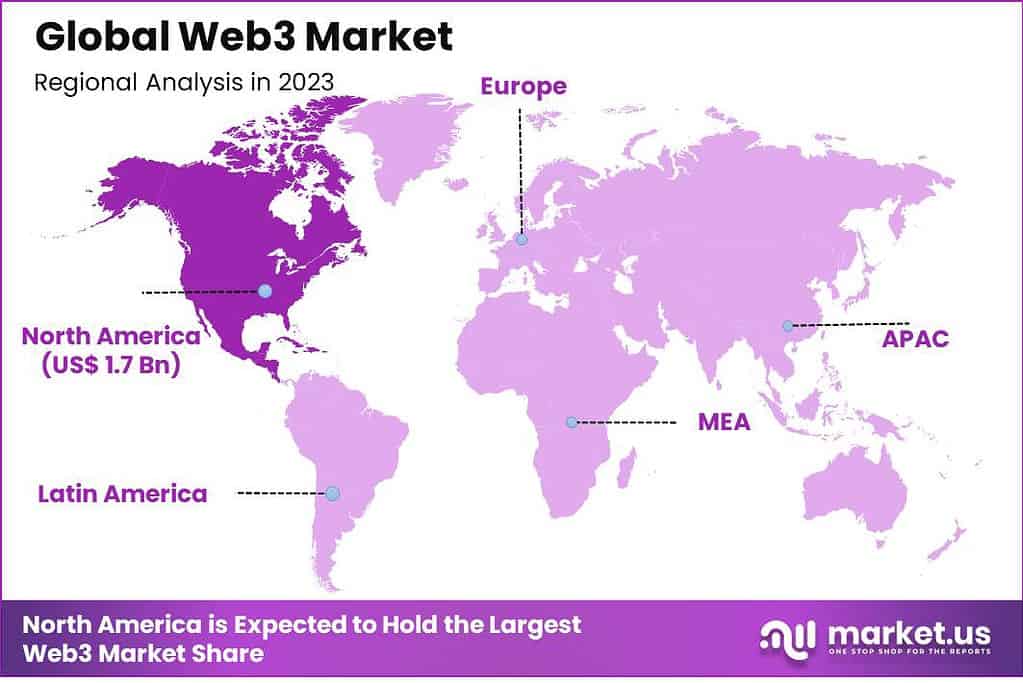

- In 2023, the Web3 market saw North America in a leading role, holding a dominant market position with over a 38% share.

Factors Affecting the Growth of the Web3 Market

- Technological Advancements: Continued advancements in blockchain technology, smart contracts, and decentralized infrastructure are crucial for the growth of the Web3 market. Improvements in scalability, interoperability, privacy, and security will drive the adoption of Web3 applications and platforms.

- User Experience: User experience plays a vital role in the adoption of any technology. Web3 applications need to provide a seamless and intuitive user interface that is as user-friendly as centralized applications. Enhancing the user experience will attract more users and fuel the growth of the Web3 market.

- Regulatory Environment: The regulatory environment surrounding cryptocurrencies, blockchain technology, and decentralized applications can significantly impact the growth of the Web3 market. Clear and supportive regulations can foster innovation and attract investment, while overly restrictive or uncertain regulations can hinder the growth of the market.

- Scalability and Performance: Scalability is a critical challenge for many blockchain networks. As the Web3 market expands, it is crucial to address scalability issues to handle a larger user base and accommodate more transactions per second. Solutions like layer 2 scaling, sharding, and improved consensus algorithms are essential for the growth of Web3.

Gain expert insights and supercharge your growth strategies. Request our market overview sample now: https://market.us/report/web3-market/request-sample/

Type Insights

In 2023, the Public segment held a dominant market position in the Web3 market, capturing more than a 56% share. This segment’s dominance can be attributed to several key factors. Firstly, public blockchains, such as Ethereum, offer a high level of transparency and decentralization, which resonates with the core principles of the Web3 movement. The open nature of public blockchains allows anyone to participate, verify transactions, and build decentralized applications (DApps), fostering innovation and inclusivity.

Moreover, public blockchains benefit from a large and active community of developers, contributors, and users. This vibrant ecosystem contributes to the continuous development and improvement of the technology, as well as the creation of diverse and valuable applications. The network effect of public blockchains further enhances their dominance, as more users and developers join the ecosystem, creating a positive feedback loop.

Furthermore, public blockchains often have their own native cryptocurrencies, which serve various purposes within the ecosystem. These tokens facilitate economic activities, incentivize network participants, and enable decentralized governance. The presence of a native cryptocurrency can attract investors and speculators, leading to increased liquidity and market capitalization.

Application Insights

In 2023, the Payments segment held a dominant market position in the Web3 market, capturing more than a 35% share. This segment’s dominance can be attributed to several factors that drive the widespread adoption of blockchain technology in the payments industry.

Web3-based payment solutions offer enhanced security and transparency compared to traditional payment systems. The immutable nature of blockchain technology ensures that transactions are tamper-proof and can be audited, reducing the risk of fraud and increasing trust among users. This heightened security is particularly valuable in the digital age, where cybersecurity threats are prevalent.

Moreover, Web3 payment solutions enable faster and more efficient cross-border transactions. Traditional payment systems often involve intermediaries, resulting in delays and high transaction costs. Web3 technologies, such as cryptocurrencies and decentralized finance (DeFi) protocols, facilitate peer-to-peer transactions with minimal intermediation, reducing both time and costs associated with cross-border payments.

Industry Vertical Insights

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the Web3 market, capturing more than a 23% share. This segment’s dominance can be attributed to several key factors that drive the adoption of Web3 technologies within the BFSI industry.

the BFSI sector is highly reliant on secure and efficient data management and transaction processes. Web3 technologies, such as blockchain and decentralized finance (DeFi), offer enhanced security, transparency, and immutability, addressing the industry’s need for robust data protection and fraud prevention. The decentralized nature of Web3 solutions eliminates the reliance on a central authority, reducing the risk of single points of failure and enhancing the overall security of financial transactions.

Moreover, Web3 technologies enable streamlined and cost-effective operations within the BFSI industry. Blockchain-based smart contracts automate and digitize various financial processes, such as trade settlement, cross-border remittances, and Know Your Customer (KYC) procedures, reducing manual intervention and paperwork. This automation leads to improved operational efficiency, reduced costs, and faster transaction settlements, making Web3 solutions highly attractive to the BFSI sector.

Don’t miss out on business opportunities in Market. Speak to our analyst and gain crucial industry insights that will help your business grow: https://market.us/book-appointment/?report_id=110420

Key Players Analysis

- Neeva

- Pinata

- Huddle01

- Polygon Technology

- Ripple Web3.0

- LeewayHertz

- Alchemy

- Consensys

- Maticz

- WeAlwin Technologies

- Other Key Players

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | US$ 4.6 Billion |

| Forecast Revenue 2033 | US$ 177.58 Billion |

| CAGR (2023 to 2032) | 44.1% |

| North America Revenue Share | 38% |

| Base Year | 2023 |

| Historic Period | 2018 to 2022 |

| Forecast Year | 2024 to 2033 |

Key Market Segments

Type

- Public

- Consortium

- Private

- Hybrid

Application

- Cryptocurrency

- Conversational AI

- Data and Transaction Storage

- Payments

- Other Applications

Industry Vertical

- IT & Telecom

- BFSI

- Media & Entertainment

- E-commerce & Retail

- Healthcare & Pharmaceuticals

- Other Industry Verticals

Plan your Next Best Move. Purchase the Report for Data-driven Insights: https://market.us/purchase-report/?report_id=110420

Driver: Increasing Adoption of Decentralized Finance (DeFi)

One driver for the global Web3 market is the increasing adoption of decentralized finance (DeFi) applications. DeFi platforms leverage blockchain and smart contract technologies to provide financial services such as lending, borrowing, and decentralized exchanges. The growing popularity of DeFi is driven by its potential to offer inclusive, transparent, and efficient financial solutions, bypassing traditional intermediaries. As DeFi gains traction, it fuels the demand for Web3 technologies and creates opportunities for innovation and growth.

Restraint: Regulatory Uncertainty

One restraint for the global Web3 market is the regulatory uncertainty surrounding blockchain and cryptocurrencies. Different countries and jurisdictions have varying approaches to regulating Web3 technologies, which can create compliance challenges for businesses operating in the space. The absence of clear and consistent regulations may hinder widespread adoption and investment in Web3 solutions. Addressing regulatory concerns and establishing a balanced regulatory framework will be crucial to unlocking the full potential of the global Web3 market.

Opportunity: Integration with Internet of Things (IoT)

One significant opportunity for the global Web3 market is the integration of Web3 technologies with the Internet of Things (IoT). By combining the decentralized nature of Web3 with the connectivity and data exchange capabilities of IoT devices, innovative solutions can be developed across industries. Web3 and IoT integration can enable secure and trusted peer-to-peer transactions, real-time data sharing, and automated smart contracts, opening up new avenues for efficiency, interoperability, and value creation.

Challenge: Scalability and Interoperability

One challenge for the global Web3 market is scalability and interoperability. As Web3 technologies gain traction and the number of transactions and users increases, scalability becomes crucial to maintain the efficiency and performance of blockchain networks. Similarly, achieving interoperability between different blockchain platforms and protocols is essential for seamless data and asset transfer across networks. Overcoming scalability and interoperability challenges requires ongoing research, innovation, and collaboration among industry participants to ensure the seamless and efficient functioning of the global Web3 ecosystem.

Regional Analysis

In 2023, North America held a dominant market position in the Web3 market, capturing more than a 38% share. The region’s dominance can be attributed to several key factors that contribute to the adoption and growth of Web3 technologies.

Firstly, North America has been at the forefront of technological innovation, particularly in the blockchain and cryptocurrency space. The region is home to many influential blockchain companies, startups, and research institutions, fostering a favorable ecosystem for Web3 development and adoption. The presence of these industry leaders, coupled with a robust venture capital landscape, has facilitated the growth of Web3 projects and attracted significant investments.

Moreover, North America has a strong and mature financial services industry, which has shown increasing interest in leveraging Web3 technologies. Banking and financial institutions in the region recognize the potential of decentralized finance (DeFi) and blockchain-based solutions for improving transparency, security, and efficiency in their operations. This awareness and willingness to explore Web3 applications have contributed to the region’s dominant market position.

Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Browse More Related Reports

- Hardware in The Loop (HIL) Market to Experience 10.1% CAGR, Enabling Insights and Innovation with a Value of USD 2,230.7 Million by 2032.

- Power device analyzer market was valued at US$ 461.3 Mn in 2022, projected to reach US$ 728.6 Mn by 2032 with a 4.8% CAGR.

- Aircraft Manufacturing Market size is projected to surpass at USD 641.6 Bn by 2033 and it is growing at a CAGR of 4.7% from 2024 and 2033.

- Current Transducer Market size is expected to be worth around USD 792.0 million by 2032, growing at a CAGR of 4.0%.

- Cyber Warfare Market is likely to attain a valuation of USD 211.6 Billion by 2033, projected to develop at a CAGR of 15.8% from 2024 to 2033.

- 2D Barcode Reader Market size is expected to be worth around USD 16.6 Bn by 2033, growing at a CAGR of 7% during forecast period.

- Vendor risk management market is anticipated to be USD 42.6 bn by 2032. It is estimated to record a steady CAGR of 15.7%.

- Application Development Software Market size is expected to be worth around USD 1,381.4 billion by 2033, growing at a CAGR of 20.7%.

- Military Wearables Market is anticipated to be USD 3.77 billion by 2033. It is estimated to record a steady CAGR of 1.8%.

- Wireless Mouse Market is projected to grow to USD 5,599.2 Million by 2032, with a significant (CAGR) of 6.7% during the forecast period.

- AI Text Generator Market is expected to grow at a CAGR of 18% during the forecast period to reach USD 1,808 million by 2032

- Automotive Predictive Maintenance Market size is expected to be worth around USD 100 Billion by 2032, growing at a CAGR of 18.6%.

- 3D printed wearables market is anticipated to be USD 9.3 billion by 2032. It is estimated to record a steady CAGR of 8.3%.

- Online Exam Proctoring Market To Reach USD 741.7 Mn In 2022 And projected to reach a revised size of USD 3,881.0 Mn By 2032.

- On-Demand Transportation Market size is projected to surpass at USD 885.0 Billion by 2032 and it is growing at a CAGR of 19.4%.

- Location Based Advertising (LBA) Market is anticipated to be USD 390.7 billion by 2033. It is estimated to record a steady CAGR of 16.1%.

- Content Analytics Market size was valued to be worth USD 6.9 Bn in 2023. it is estimated to reach USD 34.8 bn growing at a CAGR of 20.4%.

About Us

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog:

CONTACT: Global Business Development Team -Market.us Market.us (Powered By Prudour Pvt. Ltd.) Email: inquiry@market.us Address: 420 Lexington Avenue, Suite 300, New York City, NY 10170, United States Tel: +1 718 618 4351 Website: https://market.us/

![]()