- The HASH vs ICHI lawsuit presents claims for crypto fraud and theft for U.S. courts.

- According to the lawsuit, highly leveraged borrowing, insider control and collusion with repeated fund flows led to the loss of over US$16,200,000 of the investors’ funds.

- The forensic report shows ICHI lending scheme’s flaws were exploited by insiders to withdraw crypto assets belonging to other investors before its collapse for financial gain.

- The investigation traces the funds from the suspicious wallets to central exchanges pointing to attempts for liquidation and concealment, and identifies accomplices in the scheme.

NEW YORK, Jan. 14, 2026 /PRNewswire/ —

SUMMARY

– HASH Asset Management (the Plaintiff), a crypto venture capital firm, brought a lawsuit in the Court of Chancery of the State of Delaware against DMA Labs Inc. (DMA), ICHI Foundation (ICHI), their founders Bryan Gross and Nick Poore, and their associates Tyler Christian Pintar and Julian Brand aka Julian Finch-Brand (the Defendants). According to the Verified Complaint, filed on 8 April 2025, the Defendants executed a fraud scheme which caused the investors to lose over $16,200,000.

– The Amended Verified Complaint, filed with the same Court on 23 May 2025, is an action for fraud, breach of contract, breach of fiduciary duty, conversion, and piercing the veil and alter ego liability. It seeks to pierce the corporate veil of DMA to hold the individual defendants Poore and Gross liable, in addition to also asserting claims for breach of fiduciary duty and other claims against them. It clarifies and updates the lawsuit revealing more evidence on the associates in the alleged fraudulent scheme.

– The new, updated forensic expert declaration by Paul Sibenik, a certified blockchain forensics investigator, filed with the Court on 21 August 2025, gives further specific and detailed evidence, providing an in-depth analysis of the “pump-and-dump” scheme in supporting the Plaintiff’s claims.

– According to the investigation, which employed blockchain forensic tracing to identify wallet ownership and transaction flows, the collapse of the liquidity pool “Rari Pool 136” was the result of collusion, insider trading and manipulation by individuals associated with ICHI and DMA, pointing to the insiders, namely Julian Brand and Tyler Pintar, profiting from the collapse of “Rari Pool 136”.

– The findings indicate the scheme had design flaws and was exploited by ICHI insiders to borrow and withdraw assets immediately before its collapse for their own financial gain. The report asserts that highly leveraged borrowing, insider control and apparent collusion with insider-controlled wallets, and unauthorized movements of funds led to the loss of over $16,200,000 of the investors’ funds.

– The lawsuit and the expert declaration describe the alleged fraud scheme in forensic detail. As one of the lead investors who participated in the lending program by providing crypto for others to borrow, the Plaintiff brought the complaint to hold the Defendants accountable and personally liable so as to recover for their losses resulting from their misconduct and to protect the crypto community in future.

LAWSUIT: THE FRAUD SCHEME

According to the lawsuit, the Defendants issued their own cryptocurrency, ICHI, and offered a yield earning “liquidity pool” opportunity for investors. As alleged in the complaints, they perpetrated a fraud by deceitfully enticing investors to deposit crypto assets as collateral into their “Community Treasury” in return for issuing “oneTokens” (ICHI-designed “stablecoins” each worth US$1). The Defendants promised that their offering was safe and “decentralized,” and that any changes to it would be subject to a “community vote.” These representations were false. After the Plaintiff invested millions of dollars’ worth of the stablecoins into the liquidity pool called “Rari Pool 136”, the Defendants, contrary to their pledge, exerted full control over it, made unilateral decisions, removed the liquidity protections to protect their own crypto at the expense of the Plaintiff’s crypto assets, and executed a series of transactions that ultimately caused its collapse. As a result, the Plaintiff lost over US$16,200,000.

According to the filings with the Court, the sustainability of “Rari Pool 136” was possible due to an increasing price of ICHI tokens, while ICHI crypto price increase relied on continued borrowing. As soon as there was not enough buying demand for ICHI crypto to sustain the inflated price, it led to cascading liquidations in “Rari Pool 136” of which a large portion of assets had become ICHI crypto. It caused the price of ICHI to collapse by 99%, from nearly US$142 to US$1.79. When ICHI dropped in value, the Defendants executed a series of trades to protect themselves, which caused the rapid collapse of “Rari Pool 136” and the loss of nearly all the Plaintiff’s investments.

The lawsuit states that Bryan Gross, the self-appointed ICHI Foundation “steward” admitted to transferring the “Community Treasury,” with the millions of dollars’ worth of the investors’ deposits, without the required community vote. It asserts that the scheme intended to protect the Defendants’ assets and increase the price of their cryptocurrency, ICHI, at the expense of the crypto assets belonging to the investors, while the liquidity protections the Defendants touted were, in fact, illusory and false. The “Community Treasury” crypto with nearly all the Plaintiff’s investments was lost. According to the lawsuit, together with Poore and Gross, Pintar and Brand operated two primary wallets involved in the fraudulent, “pump-and-dumb” scheme and were direct participants in it.

According to the filings, HASH as a fund was only a lender in the liquidity pool, which deposited stablecoins and collected the interest payments. The Plaintiff did not buy the risky ICHI but earned the cryptocurrency as “yield” for providing “stablecoins” to “Rari Pool 136” for others to borrow.

INVESTIGATION: INITIAL FINDINGS

The Plaintiff commissioned a crypto tracing investigation by a reputable blockchain forensics and cybercrime investigative firm, Cryptoforensic Investigators, led by crypto tracing expert Paul Sibenik, which advises various cryptocurrency exchanges, and law enforcement and regulatory agencies.

The investigation firstly identified significant apparent defects of the lending scheme: a) an extremely high loan-to-value (“LTV”) ratio of 85% of “Rari Pool 136” (meaning that someone pledging US$100 worth of collateral could borrow the equivalent of US$85 in the “stablecoins“), b) it allowed borrowers to use unlimited amounts of ICHI crypto (which is not a “stablecoin“) as a collateral to borrow other crypto, including “stablecoins“, and c) there was no supply cap on the amount of assets to be deposited into “Rari Pool 136”. The depositions note that the “Angel Vault,” a liquidity protection device that the Defendants touted as a protective “buy wall” to stabilize the value of ICHI, also failed.

According to the report, the focus of the Defendants’ scheme was to: 1) displace the “stablecoin” and other valuable cryptocurrencies from “Rari Pool 136” in exchange for the highly risky ICHI, 2) to use borrowed “stablecoins” or other cryptocurrencies to purchase more ICHI, which would drive up the price of ICHI, and 3) to use that purchased ICHI as a collateral in “Rari Pool 136” to borrow more “stablecoins” and other cryptocurrencies and to continuously repeat this cycle. This scheme was possible as ICHI could be used as both the collateral for borrowers and the proceeds of the loan from “Rari Pool 136”. As a result, while the Plaintiff reasonably thought that “oneTokens” and other safer cryptocurrencies were protected, “Rari Pool 136” was completely reliant on the price of ICHI.

The investigation identified that the key transactions which caused the collapse of “Rari Pool 136” were executed by digital addresses linked to the ICHI Foundation and DMA insiders.

MORE INSIGHT INTO SCHEME TRANSACTIONS AND ACCOMPLICES

According to the Amended Verified Complaint (which exposes and scrutinizes activities of the associates of ICHI founders), Julian Finch, also known as Julian Brand or “BlueJay”, and Tyler Christian Pintar, were involved in a coordinated scheme to extract significant funds from the ICHI protocol’s treasury through insider access and manipulation of system parameters. Both individuals appear to have played key roles in the use of recursive leverage and unauthorized borrowing that led to the destabilization of the protocol and contributed to the collapse of the “Rari Pool 136” platform.

As alleged, Julian Brand and Tyler Pintar are believed to have executed large borrowing transactions shortly after treasury funds were moved – often within minutes – indicating potential coordination or foreknowledge of internal decisions. These activities involved borrowing “stablecoins“, purchasing ICHI tokens to influence price movement, and using those tokens as a collateral to further increase borrowing. During this time, the protocol settings such as loan-to-value ratios were modified, and liquidity was removed or dispersed in a manner that hindered liquidations and amplified systemic risk.

The filing points to the fact that Julian Brand had previously served in a business development role at ICHI and continued to be publicly associated with crypto-related initiatives after his departure, while Tyler Pintar, similarly, maintained active involvement in decentralized finance through various accounts and projects. Their past activity, including the wallets’ behavior and their public affiliations, appears to align with the patterns observed during the collapse of the ICHI protocol.

NEW FORENSIC REPORT: EVIDENCE OF COLLUSION AND INSIDER TRADING

The forensic investigation aimed to assess whether ICHI founders and their associates, including DMA Labs., were likely behind or played a role in the collapse of “Rari Pool 136” for their own financial gain, and whether there is any indication of insider trading by individuals that were part of or associated with the ICHI Foundation.

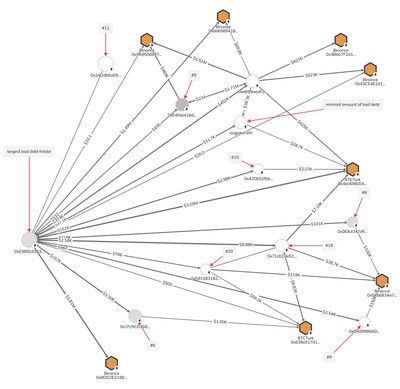

In particular, the investigation identified the key wallets tied to insiders, including 0xd415 (Tyler Pintar, $13.09M of bad debt) and 0xfb06 (Julian Brand, $12.21M of bad debt), 0x4fe (ICHI Team, $5.644M of bad debt) and 0xc8b5 (Unknown, but with link to ICHI Team, the largest bad debt holder of $15.46M), and other linked addresses apparently operated or influenced by ICHI associates, which points to insider trading. The expert report suggests that the users with a large amount of bad debt (in the millions of dollars) knew that they were exploiting design flaws in “Rari Pool 136” and that it would likely collapse as a result of continuing to leverage ICHI and borrowing “stablecoins“.

The report identifies that on 6 April 2022, when Julian Brand borrowed $1.8M USDC, the ICHI team transferred $5M USDC and 43 wBTC from the “Community Treasury” without the required “community vote”. It points to other transactions between April 7 and 9 by Brand and Pintar borrowing millions of dollars’ worth of USDC and other crypto assets, just days before ICHI price collapsed. Overall, it shows evidence of transfers from the “Community Treasury”, totalling $9M, which evidently allowed insiders to profit while depleting the collateral reserves meant to protect investors. The report notes that the funds from the identified suspicious wallets were traced to centralized exchanges (including Binance, Kraken, BTCTurk, and stake.com), indicating attempts for liquidation and concealment, while the pattern of repeated fund flows demonstrates collusion and insider trading.

In his conclusion, Paul Sibenik specifies that, based on the analysis of blockchain data and events: 1) a small number of users were likely involved in the exploit of “Rari Pool 136”, while some of the other addresses might also be controlled by individuals that were part of or affiliated with the ICHI Team; 2) the ICHI Team directly transacted numerous times with multiple suspicious addresses with significant bad debt “which is suggestive of insider trading by the ICHI Team multiple individuals, some known and others unknown, who played a critical role in the collapse of Rari Pool 136”, 3) Julian Brand and Tyler Pintar attempted to borrow as much as they could from Rari Pool 136 in the days prior to the collapse, and during the collapse itself, while at the same time the ICHI team moved assets from the “Community Treasury” to “Rari Pool 136” “without the required community vote, allowing insiders, including Brand and Pintar to profit more and more from the inherent flaws in the protocol”, 4) “insiders were able to deplete Rari protocol of the limited USDC available before other users could redeem, possibly due to inside information that insiders like Brand and Pintar may have had”.

The findings document the scheme had design flaws exploited by ICHI insiders to borrow and withdraw assets immediately before its collapse for their own financial gain. The report shows the evidence disproving ICHI’s claims of “decentralization” such as the unauthorized movements of funds without the community vote (while the community voting system systems are meant to protect against centralized bad actors making unilateral decisions that harm stakeholders). The report evidences that highly leveraged borrowing, insider control and collusion with insider-controlled wallets, and identified unauthorized movements of funds – led to the loss of over $16,200,000 of the investors’ funds.

About HASH Asset Management

HASH Asset Management Ltd is a crypto venture capital firm specializing in decentralized finance (DeFi) and blockchain projects. It is driven by experts in crypto and DeFi, blockchain technology, investment banking, and trading and data analytics, united by the goal of bringing institutional level of service quality to the rapidly developing crypto-assets market.

Photo – https://cryptocoinsnet.com/wp-content/uploads/2026/01/HASH_Asset_Management.jpg

PDF – https://mma.prnewswire.com/media/2861594/Declaration.pdf

PDF – https://mma.prnewswire.com/media/2861593/Amended_Complaint.pdf

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/hash-asset-managements-lawsuit-vs-ichi-crypto-founders-and-associates-new-forensic-report-shows-collusion-and-insider-trading-in-a-fraud-pump-and-dump-scheme-302661395.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/hash-asset-managements-lawsuit-vs-ichi-crypto-founders-and-associates-new-forensic-report-shows-collusion-and-insider-trading-in-a-fraud-pump-and-dump-scheme-302661395.html

SOURCE HASH Asset Management

![]()