Vorexlan is a automated trading platform offering real-time analytics, AI-driven portfolio automation, global asset access, and secure broker-integrated execution.

New York City, NY, Dec. 02, 2025 (GLOBE NEWSWIRE) — What Is Vorexlan? Inside the 2026 Automated Trading Platform

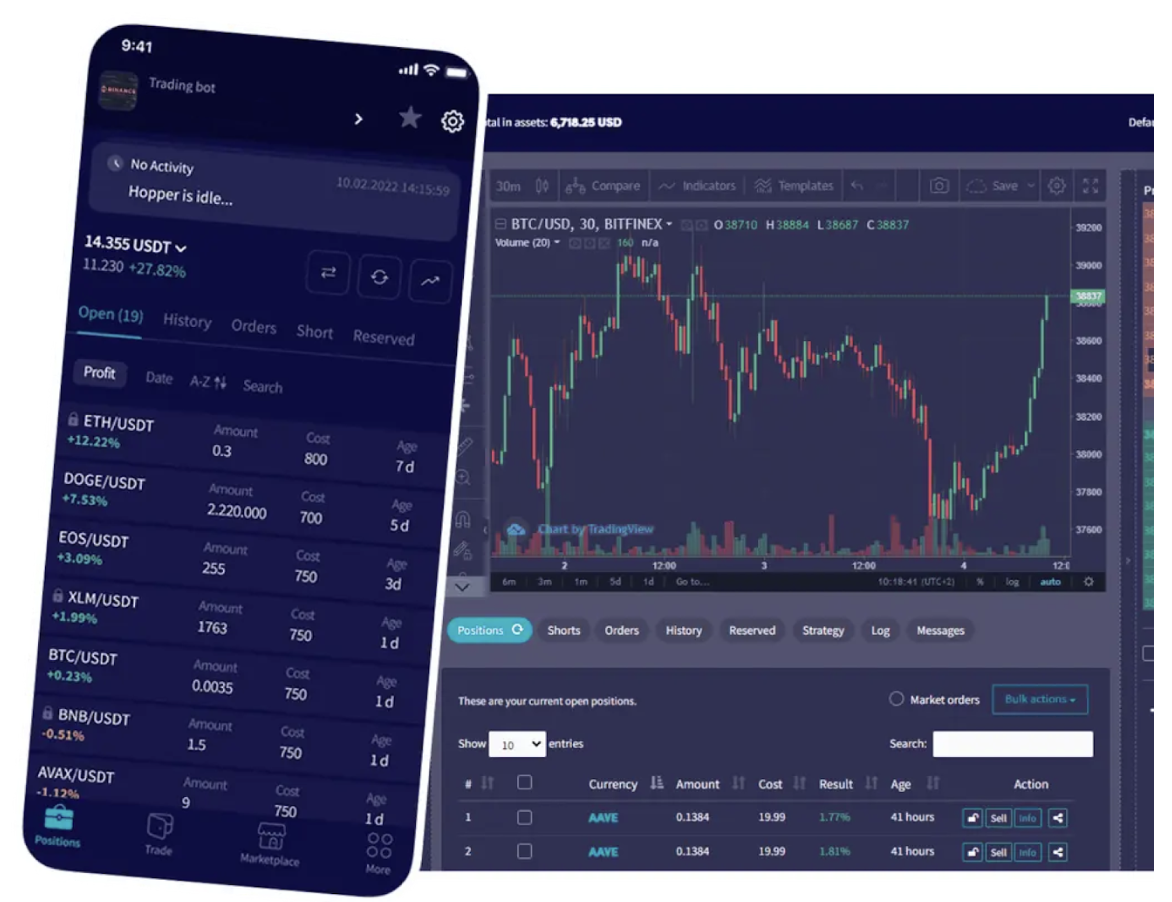

Vorexlan is a automated trading system engineered to streamline market participation through real-time analytics, automated trade execution, and AI-powered decision support. Designed as a multi-asset platform, Vorexlan integrates advanced computational models to help users analyze market trends, detect micro-movements, and manage diversified portfolios without manual monitoring. The system functions as a technical backbone that processes large volumes of financial data, transforming raw market metrics into structured, actionable insights.

At its foundation, Vorexlan incorporates machine learning layers that review historical performance models, volatility patterns, and cross-market relationships. These analytical engines allow the platform to recognize emerging trends and respond with algorithm-driven positioning strategies. This approach minimizes delays commonly seen in manual trading environments and creates a more efficient, predictable workflow for individuals who require consistent system guidance.

Vorexlan also offers a broad spectrum of asset access, including cryptocurrencies, forex pairs, commodities, and other global markets. The platform is built to accommodate both short-term and long-term trading strategies, supporting diversified portfolio structures where automated systems are favored for accuracy and speed.

With its secure cloud-based infrastructure, Vorexlan provides protected access, encrypted sessions, and regulatory-compliant broker connections. These elements ensure that the automated environment is supported by strong backend safeguards designed to mitigate operational risks. As 2025 unfolds with increased volatility and fast-changing market dynamics, Vorexlan positions itself as a structured trading environment where automation, analytics, and global accessibility converge to offer users a streamlined financial interface.

Join Vorexlan Now – Visit Official Website Now

Key Features of Vorexlan – Real-Time Analytics, Portfolio Automation & Global Asset Access

Vorexlan integrates multiple high-performance trading features that operate collectively to deliver real-time insights and automated portfolio support. At the core of its system is a dynamic analytics engine designed to monitor market conditions across global exchanges. This engine evaluates pricing data, volume fluctuations, sentiment indicators, and macroeconomic triggers to provide continuous, up-to-the-second information for automated decision-making.

The platform’s portfolio automation feature allows users to allocate capital across various markets while maintaining structured risk controls. Through rules-based automation, Vorexlan initiates and adjusts positions using algorithm-enabled signals derived from market behavior. This eliminates the need for constant manual tracking and ensures that automated strategies remain aligned with shifting market cycles.

The system also provides extensive asset access, including cryptocurrencies, foreign exchange markets, major commodities, and additional trading instruments. This global access supports model diversification, allowing users to deploy automated frameworks across multiple asset groups simultaneously. The platform’s ability to detect correlations between these markets contributes to more stable portfolio structures.

Additionally, Vorexlan includes a transparent workflow for liquidity routing, execution speeds, and system-triggered trade placement. These optimizations help reduce latency and create a consistent operational environment where automation can function with precision. With its combination of global accessibility, live analytics, and automated trade responses, Vorexlan positions itself as an adaptive trading infrastructure tailored for fast-paced, data-intensive markets in 2025-26.

Visit the Official Vorexlan Website Now

Why Traders Trust Vorexlan – Transparency, Speed, and Verified Performance Data

Vorexlan presents a transparency-centered operational framework built to support users with clear data visibility, predictable execution behavior, and structured reporting. The platform maintains a straightforward architecture where users can track market inputs, algorithmic triggers, and internal decision pathways. This degree of transparency allows individuals to understand how system actions are generated, ensuring clarity throughout the automated trading workflow.

Speed is another foundational component of the Vorexlan infrastructure. Automated systems rely on rapid processing to interpret market conditions and deploy responses without manual delay. Vorexlan achieves this with optimized data pipelines capable of evaluating multiple indicators in real time. Its execution system interacts with liquidity channels through verified brokers, enabling trades to be processed with minimal lag—an essential requirement for high-volatility markets such as cryptocurrency and forex.

In addition to speed and transparency, Vorexlan emphasizes accuracy through structured performance reporting. The platform generates data logs, historical analytics, and activity summaries that allow users to review system behavior objectively. These performance insights help maintain accountability in the automated environment, reinforcing reliability and ensuring that users can validate how algorithms manage positions over time.

Vorexlan’s emphasis on structured analytics, operational visibility, and system integrity forms the basis for its use in real-time trading environments. With its 2025 technology stack, the platform offers a fortified structure designed to support informed decision automation and maintain consistency across fluctuating global markets.

Register on the Vorexlan trading application

Vorexlan Account Setup Process – Step by Step

Vorexlan’s account setup process is structured to be straightforward, secure, and aligned with the platform’s automation-first architecture. The onboarding workflow is designed to verify user identity, establish secure access credentials, and connect users with a regulated brokerage channel. Below is the complete setup process in clear, SEO-optimized bullet format:

Step-By-Step Vorexlan Registration Process

- Visit the Official Registration Page:

Begin by accessing the official Vorexlan website and navigating to the registration form. - Submit Basic User Details:

Enter your full name, email address, mobile number, and preferred country of operation. - Create Secure Login Credentials:

Set a strong password for account access. The system generates encrypted storage and two-factor authentication options. - Broker Assignment & Verification:

Vorexlan automatically connects you with a partnered, regulated broker to facilitate real-time trading access. - Identity Verification (KYC):

Upload a government-issued ID and proof of residence. This ensures regulatory compliance and platform security. - Minimum Deposit Requirement:

Make the required initial deposit—typically $250, depending on region and brokerage rules. This activates your trading dashboard. - Access the Trading Dashboard:

Once funded, users are granted access to real-time analytics, automated features, asset lists, and market data. - Activate Demo or Live Mode:

Users may start with demo mode for system familiarization or switch directly to live automated trading.

This structured setup process enables users to begin interacting with Vorexlan’s automated analytics, execution framework, and multi-asset environment efficiently and securely.

Unlock smarter trading with Vorexlan — Visit the Official Website Here

How Vorexlan Works – AI-Driven Market Insights & Smart Trade Execution

Vorexlan operates through an interconnected architecture that interprets live market data, analyzes multi-layer indicators, and triggers automated trading actions. At the core of its functionality is an AI engine built to assess thousands of data points simultaneously. This includes trend lines, volatility patterns, breakout zones, trading volumes, and historical micro-behavior patterns—each contributing to its decision matrix.

The AI system continuously processes these metrics and converts them into structured signals that guide automated actions. These signals determine whether the platform should execute, pause, or modify a trading position. Vorexlan further integrates high-frequency data streams sourced from global markets, ensuring that its insights reflect the latest conditions.

Trade execution is handled through a smart-routing system linked to partnered brokers. This system ensures that trades entered by the AI are executed at optimal market prices, minimizing slippage and delay. The automation engine reacts to verified signals rather than manual prompts, enabling consistent and rapid positioning.

Risk filters embedded within the engine help maintain controlled exposure. These filters adjust strategies according to volatility levels, predefined risk preferences, and real-time shifts in price behavior. As a result, the platform’s automated structure consistently adapts to the changing nature of financial markets.

Overall, Vorexlan functions as a hybrid system combining analytics, machine-driven insight, and automated execution. This creates a seamless trading setup where decisions are supported by real-time intelligence rather than manual intervention.

AI Intelligence Behind Vorexlan – How Machine Learning Optimizes Every Trade

Vorexlan’s intelligence layer is powered by machine learning models designed to evolve through continuous data interaction. The platform does not rely on static rule sets; instead, it incorporates adaptive algorithms that refine their behavior based on historical and ongoing market performance. This ensures that the system aligns its decision framework with emerging trends rather than outdated patterns.

Machine learning modules evaluate patterns across multiple indicators, including price oscillations, momentum shifts, volume spikes, and cross-asset correlations. As these models process new datasets, they adjust internal weights to improve prediction accuracy and response timing. This adaptability is essential in fast-moving markets where traditional decision-making methods often lag.

Another key component is Vorexlan’s multi-layer neural model. This structure allows the platform to process data in parallel, detecting hidden relationships between assets and identifying market conditions that align with specific trade patterns. The platform also incorporates anomaly detection models that identify irregular price behavior, ensuring that automated responses remain controlled during unexpected volatility.

Data normalization frameworks ensure that incoming information is cleaned, categorized, and standardized for rapid processing. This boosts the accuracy of predictive modeling and reduces noise in the analytical pipeline.

Through this machine learning architecture, Vorexlan enhances its ability to execute precise, consistent, and timely decisions, providing a technology foundation capable of managing high-volume trading workflows across global markets.

Visit the Official Vorexlan Website Now

Deposits & Withdrawals – Fast, Seamless, and Fully Secure Transactions

Vorexlan provides a streamlined transactional system designed to process deposits and withdrawals through secure, encrypted channels. The platform connects users directly with partnered financial institutions and brokers, ensuring that all monetary operations comply with regulatory standards. The deposit workflow typically supports multiple payment formats, including debit cards, credit cards, direct transfers, and region-specific gateways.

Withdrawals operate under a structured verification process that protects account integrity. Before funds are released, the system confirms user identity to prevent unauthorized access. This ensures that each transaction is compliant with global AML (Anti-Money Laundering) and KYC (Know Your Customer) requirements.

Encryption protocols safeguard sensitive financial data throughout the process. These include SSL encryption, tokenized session systems, and end-to-end data protection mechanisms. The platform also maintains audit trails to track transactional activity, adding an extra layer of transparency and operational accountability.

Processing times for deposits are usually instant, enabling immediate access to the trading dashboard. Withdrawals may vary based on the assigned broker and payment method but typically fall within a standard processing window designed to ensure both security and operational accuracy.

By maintaining a predictable, fast, and secure financial system, Vorexlan supports uninterrupted trading operations while ensuring full compliance with international financial standards.

Why Choose Vorexlan? Italy Consumer Report Released Here

Demo Mode, Easy Registration & Low Minimum Deposit Requirements

Vorexlan incorporates a simplified registration structure and accessible entry requirements, making it operational for individuals seeking automated trading solutions. The system’s demo mode serves as a simulation environment where users can explore its features without financial exposure. This training module mirrors live market behavior using real-time data feeds, allowing users to test automated strategies and review system behavior.

The registration workflow is lightweight and involves basic user information, regulatory verification, and secure account creation. Once registered, users are automatically connected to a licensed broker for market access.

The platform maintains a low minimum deposit requirement—typically $250—allowing a wide range of users to initiate automated trading without large capital commitments. This initial funding activates the full suite of Vorexlan tools, including real-time data feeds, portfolio automation, and execution modules.

These combined features create an environment where users can learn, test, and transition to live trading with confidence, supported by a structured, secure backend infrastructure.

Vorexlan – Cost, Minimum Deposit, and Profit

Vorexlan operates on a cost structure designed around accessibility and transparency. The platform itself generally does not charge registration or subscription fees; instead, users interact with costs associated with the partnered brokers handling trade execution. These may include standard market spreads, rollover charges, or instrument-specific fees depending on the asset class.

The minimum deposit for activating a Vorexlan account is typically $250, though the exact requirement may vary based on region and broker assignment. This initial deposit grants full access to the platform’s automated features, analytics dashboards, portfolio tools, and demo/live environments.

Profit potential is inherently tied to market performance, the behavior of automated strategies, and the volatility of selected assets. Vorexlan provides analytical and automated tools that assist with decision timing and risk management, but outcomes vary with market conditions. The platform focuses on maintaining structural efficiency—fast execution, continuous data evaluation, and automated decision support—to create an optimized trading environment rather than guaranteeing returns.

This transparent cost and deposit structure allows users to interact with the AI-driven system while maintaining full visibility into operational parameters.

Future of Investing Is Here – Visit the Official Vorexlan Website Now

Countries Where Vorexlan Is Legal

Vorexlan operates within regions where its partner brokers maintain regulatory compliance and legal authorization. Availability generally includes jurisdictions across Europe, Asia, Latin America, Oceania, and select markets in Africa. The platform adheres to the legal frameworks defined by regulatory bodies governing online trading, financial technology services, and brokerage operations in these countries.

Certain regions may restrict automated trading systems or enforce additional compliance layers. Where applicable, Vorexlan ensures that onboarding includes identity verification, documentation, and brokerage compliance checks to align with local financial laws.

Availability may vary depending on regional financial regulations, but Vorexlan maintains global operational accessibility through licensed third-party brokers that enable safe, structured trading within approved jurisdictions.

Vorexlan Multi-Asset Trading Access

Vorexlan supports multi-asset market participation, allowing users to diversify across crypto, forex, commodities, indices, and additional instruments. This structure provides access to markets that operate across different time zones, ensuring continuous data flow and uninterrupted automated activity.

Multi-asset access allows the AI engine to analyze inter-market correlations, enabling better trend detection and diversified automated strategy deployment. This wide asset coverage also ensures that global events, currency shifts, and commodity fluctuations can be integrated into the platform’s decision framework.

With strong multi-market connectivity, Vorexlan enhances portfolio diversification and supports more complex automated strategies that rely on multiple data sources rather than single-market input.

Why Choose Vorexlan? Norway Consumer Report Released Here

Supported Assets & Broker Partnerships – Vorexlan Global Reach Explained

Vorexlan integrates with brokers that support broad asset catalogs, offering access to cryptocurrencies, forex pairs, commodities, indices, and sometimes equities depending on jurisdiction. These partnerships ensure that users receive live pricing, market liquidity, and regulated execution environments.

The platform relies on broker connectivity to route trades, maintain compliance, and deliver real-time data streams. This global network enables Vorexlan to function as a unified trading environment regardless of the user’s location, provided the region is jurisdictionally approved.

Through regulated brokers, the platform maintains alignment with financial standards, operational transparency, and secure execution workflows, supporting seamless global reach.

Risk Management, Demo Mode & Customizable Strategies Explained

Risk management tools in Vorexlan are built to maintain controlled exposure across volatile markets. These include stop-loss functions, automated thresholds, diversification models, and adjustable parameters that users can configure according to their risk tolerance.

The demo mode enables users to practice with system settings, evaluate AI-driven performance, and adjust strategy configurations before entering live environments. Customizable strategies allow users to modify instructions such as trade size, risk level, market focus, and automated thresholds to align the platform with their personal trading structure.

This combination of training tools, customization, and built-in risk management creates a structured environment where automated strategies operate within clearly defined safety parameters.

Join Vorexlan Now – Visit Official Website Now

Why Traders Are Choosing Vorexlan Over Manual Platforms

Vorexlan offers an AI-first architecture that responds to market behavior at speeds which manual trading workflows cannot replicate. The platform’s automated decision-making framework evaluates multiple data points simultaneously, enabling trade execution based on structured logic rather than emotional response or delayed manual observation.

The analytics engine supports consistent monitoring of global markets, producing actionable insights around the clock. This reduces the need for continuous human supervision and creates a more efficient environment for traders who require dependable market tracking.

Vorexlan’s operational stability is further supported by its broker connectivity, risk controls, and machine learning modules, forming a comprehensive infrastructure designed to streamline trading through automation, speed, and analytical precision.

Security Protocols & Broker Partnerships Behind Vorexlan

Security is integrated into every layer of the Vorexlan ecosystem. The platform uses SSL encryption, tokenized session systems, and secure user authentication to protect account access. Financial transactions undergo encrypted processing to safeguard sensitive information, and the system maintains compliance with international data protection standards.

Its broker partnerships ensure that trade execution, fund storage, and market routing are handled by regulated institutions. Brokers operate under financial oversight, providing secure liquidity channels, identity verification, and anti-fraud monitoring.

This combined security architecture ensures that both the technological and financial components of the platform operate within protected, compliance-aligned frameworks.

Final Takeaway – Vorexlan as the Next Evolution in Automated Trading Intelligence

Vorexlan stands as a structured, technology-driven trading solution built on real-time analytics, automated execution systems, and multi-asset access. Its 2026 architecture reflects advancements in machine learning, secure financial connectivity, and global data integration. The platform’s infrastructure is designed to deliver continuous monitoring, structured decision support, and automated portfolio management in an environment where market conditions shift rapidly.

With its combination of AI-driven analysis, secure operations, and algorithmic precision, Vorexlan represents a new stage in the evolution of digital trading systems. The platform offers a unified environment where automation, data intelligence, and regulatory-aligned partnerships work together to support efficient trading across global markets.

Visit the Official Vorexlan Website Now

Contact:-

Vorexlan

Piazza della Repubblica 19, Milano, Italy

Phone Support: +39 02 8359 1500

Email: admin@fesnojiv.org

Website: https://vorexlan.com/

General Disclaimer:

The content provided in this article is for informational and educational purposes only. It does not constitute financial, legal, or professional advice. Readers are advised to consult a certified financial advisor, licensed loan officer, or legal professional before making any financial decisions. The information presented may not apply to every individual circumstance and is not intended to substitute professional judgment or regulatory guidance. The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. We does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

Trading Disclaimer:

Trading cryptocurrencies carries a high level of risk, and may not be suitable for all investors. Before deciding to trade cryptocurrency you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with cryptocurrency trading, and seek advice from an independent financial advisor. ICO’s, IEO’s, STO’s and any other form of offering will not guarantee a return on your investment.

HIGH RISK WARNING: Dealing or Trading FX, CFDs and Cryptocurrencies is highly speculative, carries a level of non-negligible risk and may not be suitable for all investors. You may lose some or all of your invested capital, therefore you should not speculate with capital that you cannot afford to lose. Please refer to the risk disclosure below. Vorexlan does not gain or lose profits based on your activity and operates as a services company. Vorexlan is not a financial services firm and is not eligible of providing financial advice. Therefore, Vorexlan shall not be liable for any losses occurred via or in relation to this informational website.

SITE RISK DISCLOSURE: Vorexlan does not accept any liability for loss or damage as a result of reliance on the information contained within this website; this includes education material, price quotes and charts, and analysis. Please be aware of and seek professional advice for the risks associated with trading the financial markets; never invest more money than you can risk losing. The risks involved in FX, CFDs and Cryptocurrencies may not be suitable for all investors. Vorexlan doesn”t retain responsibility for any trading losses you might face as a result of using or inferring from the data hosted on this site.

Attachment

CONTACT: Contact:- Vorexlan Piazza della Repubblica 19, Milano, Italy Phone Support: +39 02 8359 1500 Email: admin@fesnojiv.org Website: https://vorexlan.com/

![]()