Understand the significant growth trajectory of the Cryptocurrency Hardware segment, which is expected to reach US$2.9 Billion by 2030 with a CAGR of a 14.2%. The Cryptocurrency Software segment is also set to grow at 17.3% CAGR over the analysis period. Gain insights into the U.S. market, valued at $557.8 Million in 2024, and China, forecasted to grow at an impressive 14.6% CAGR to reach $779 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Dublin, March 17, 2025 (GLOBE NEWSWIRE) — The “Cryptocurrency Trends – Global Strategic Business Report” report has been added to ResearchAndMarkets.com’s offering.

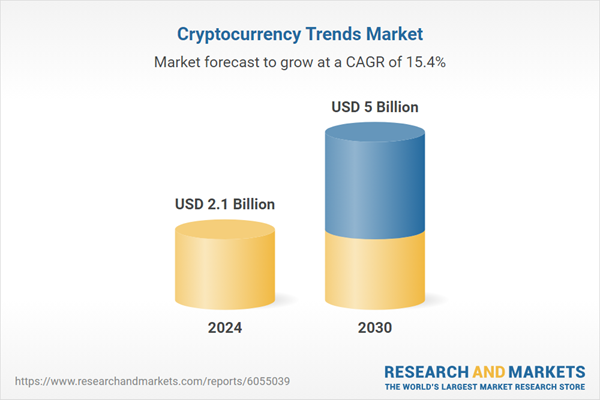

The global market for Cryptocurrency Trends was valued at US$2.1 Billion in 2024 and is projected to reach US$5 Billion by 2030, growing at a CAGR of 15.4% from 2024 to 2030. This comprehensive report provides an in-depth analysis of market trends, drivers, and forecasts, helping you make informed business decisions.

The cryptocurrency market has revolutionized financial transactions by introducing decentralized, secure, and efficient methods of exchanging value. Unlike traditional banking systems, cryptocurrencies leverage blockchain technology to eliminate intermediaries, ensuring transparency and reducing transaction costs.

Bitcoin, the first cryptocurrency, remains a dominant force in the market, but altcoins like Ethereum, Binance Coin, and Solana are driving diversification by offering unique functionalities such as smart contracts and decentralized applications (dApps). These innovations are reshaping how individuals and businesses interact with financial systems, paving the way for more inclusive and accessible economies.

What are Key Factors Driving Growth in the Cryptocurrency Market?

The growth in the cryptocurrency market is driven by several factors, each contributing to its rapid evolution and global acceptance. The primary driver is the increasing demand for decentralized financial systems that offer security, transparency, and autonomy. The integration of blockchain technology with cryptocurrencies ensures immutable and tamper-proof transaction records, fostering trust among users and institutions. The growing popularity of digital payments, accelerated by the COVID-19 pandemic, has also propelled cryptocurrencies into mainstream financial ecosystems. In particular, the adoption of stablecoins has addressed concerns around volatility, facilitating their use in day-to-day transactions and cross-border payments.

Institutional adoption has emerged as a critical driver, with major companies and investment firms entering the market. Hedge funds, venture capitalists, and even national governments are now recognizing cryptocurrencies as a legitimate asset class. The rise of DeFi platforms, which offer banking services without traditional intermediaries, is further driving market growth by providing unprecedented financial inclusion. Additionally, technological advancements like energy-efficient blockchain protocols and interoperability solutions are addressing scalability and environmental concerns, ensuring sustainable growth. Government initiatives, such as the exploration of central bank digital currencies (CBDCs), are also fostering legitimacy and driving broader adoption, making cryptocurrency a cornerstone of the future financial system.

What Innovations are Shaping the Future of Cryptocurrencies?

The cryptocurrency ecosystem thrives on continuous innovation, which has expanded its use cases far beyond digital payments. Smart contracts, pioneered by Ethereum, have transformed blockchain networks into programmable platforms, enabling automated and secure execution of agreements without intermediaries. This has given rise to decentralized finance (DeFi), a burgeoning sector offering services like lending, borrowing, and staking without the need for traditional banks. DeFi protocols have attracted billions of dollars in investments, highlighting the market’s potential to disrupt conventional finance.

Another groundbreaking innovation is the advent of non-fungible tokens (NFTs), which are reshaping industries like art, gaming, and entertainment by enabling verifiable ownership of digital assets. Layer-2 solutions, such as the Lightning Network for Bitcoin and Polygon for Ethereum, are addressing scalability issues, allowing blockchains to handle more transactions at lower costs. Moreover, eco-friendly cryptocurrencies and blockchain protocols like Cardano and Solana are gaining traction as the market seeks sustainable solutions to mitigate the environmental impact of energy-intensive mining processes. These technological advancements are not only expanding the scope of cryptocurrencies but also reinforcing their relevance in an increasingly digital economy.

Can Changing Consumer Preferences Drive Cryptocurrency Adoption?

Consumer preferences are a critical factor driving the growth and adoption of cryptocurrencies, as users seek financial systems that prioritize transparency, security, and autonomy. Millennials and Gen Z, in particular, are leading this shift, favoring digital assets as an investment vehicle over traditional assets like stocks and bonds. This demographic’s preference for decentralized systems is also reflected in the rise of peer-to-peer (P2P) crypto trading platforms, which offer enhanced privacy and control over transactions. Additionally, the growing distrust in fiat currencies, fueled by inflation and economic instability, has spurred interest in cryptocurrencies as a hedge against financial uncertainty.

The integration of cryptocurrency with mainstream financial services is also influencing consumer behavior. Payment giants such as Visa and Mastercard now offer crypto-linked cards, allowing users to spend their digital assets seamlessly in everyday transactions. The increasing availability of crypto-based rewards programs and loyalty schemes further incentivizes adoption. Moreover, advancements in user-friendly wallets and mobile applications have simplified access to cryptocurrencies, attracting less tech-savvy consumers. As awareness and education around blockchain technology grow, consumer confidence in cryptocurrencies is expected to deepen, solidifying their role in the future financial landscape.

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ballet Global Inc., BitMain Technologies Holding Company, CoinTracker, Ember Fund Inc., Gemini Trust Company, LLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Segments

- Offering (Hardware Offering, Software Offering)

- Process (Mining Process, Transaction Process)

- Type (Bitcoin Cryptocurrency, Ethereum Cryptocurrency, Bitcoin Cash Cryptocurrency, Ripple Cryptocurrency, Litecoin Cryptocurrency, Dash Cryptocurrency, Other Types)

- Application (Trading Application, eCommerce & Retail Application, Peer-to-Peer Payment Application, Remittance Application)

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 84 |

| Forecast Period | 2024 – 2030 |

| Estimated Market Value (USD) in 2024 | $2.1 Billion |

| Forecasted Market Value (USD) by 2030 | $5 Billion |

| Compound Annual Growth Rate | 15.4% |

| Regions Covered | Global |

Key Topics Covered:

MARKET OVERVIEW

- Influencer Market Insights

- Global Market Prospects & Outlook

- Economic Frontiers: Trends, Trials & Transformations

- Cryptocurrency Trends – Global Key Competitors Percentage Market Share in 2025 (E)

- Competitive Market Presence – Strong/Active/Niche/Trivial for Players Worldwide in 2025 (E)

MARKET TRENDS & DRIVERS

- Blockchain Technology Strengthens Business Case for Decentralized Transactions

- Institutional Adoption Bodes Well for Market Growth

- Stablecoins Expand Addressable Market Opportunity for Low-Volatility Transactions

- Non-Fungible Tokens (NFTs) Spur Growth in Digital Asset Ownership

- Decentralized Finance (DeFi) Platforms Propel Adoption of Banking Alternatives

- Crypto Payment Solutions Generate Demand for Cross-Border Payment Innovation

- Rise of Digital Wallets Expands Cryptocurrency Accessibility for Retail Consumers

- Increased Regulatory Clarity Strengthens Business Case for Mainstream Integration

- 5G Networks Propel Growth in Real-Time Cryptocurrency Applications

- Gaming and Metaverse Trends Drive Adoption of In-Game Cryptocurrencies

- Integration with E-Commerce Platforms Spurs Growth of Digital Payments

- Social Media and Influencer Campaigns Bode Well for Cryptocurrency Awareness and Growth

FOCUS ON SELECT PLAYERS:Some of the 47 companies featured in this Cryptocurrency Trends market report include:

- Ballet Global Inc.

- BitMain Technologies Holding Company

- CoinTracker

- Ember Fund Inc.

- Gemini Trust Company, LLC

- Tether Operations Limited.

- Tokenetics

For more information about this report visit https://www.researchandmarkets.com/r/3f2nig

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com

Laura Wood,Senior Press Manager

press@researchandmarkets.com

For E.S.T Office Hours Call 1-917-300-0470

For U.S./ CAN Toll Free Call 1-800-526-8630

For GMT Office Hours Call +353-1-416-8900

![]()