HONG KONG, March 07, 2025 (GLOBE NEWSWIRE) — CoinEx Research’s February 2025 report pointed out a significant downturn in the cryptocurrency market. Driven by a confluence of bearish factors, including macroeconomic uncertainties, institutional outflows, and political turmoil in the meme token sector. Bitcoin, which started the month at $102,000, fell sharply to below $80,000, sparking widespread concerns. This decline, accompanied by heightened global tensions, including new trade tariffs proposed by the Trump administration, caused a ripple effect across the digital asset landscape. Meanwhile, significant security breaches, such as the Bybit hack, further contributed to the overall negative sentiment. Despite these challenges, innovative developments, such as Berachain’s mainnet launch, provided some hope, with stablecoin inflows suggesting that a bull market structure could still be intact.

The Bear and the Fear

The cryptocurrency market in February was dominated by bearish sentiment, with the Fear and Greed Index consistently hovering in the “fear” zone. Bitcoin experienced a sharp decline, dropping below the crucial $80,000 mark after starting the month at $102,000. The downturn was exacerbated by the liquidity exhaustion following the launch of high-profile meme tokens, including Trump and Melania tokens. Additionally, the market was rocked by the LIBRA token scandal, which involved accusations of manipulation and a drastic price drop after initial hype. This scandal further eroded investor confidence, pulling Ethereum and Solana prices lower.

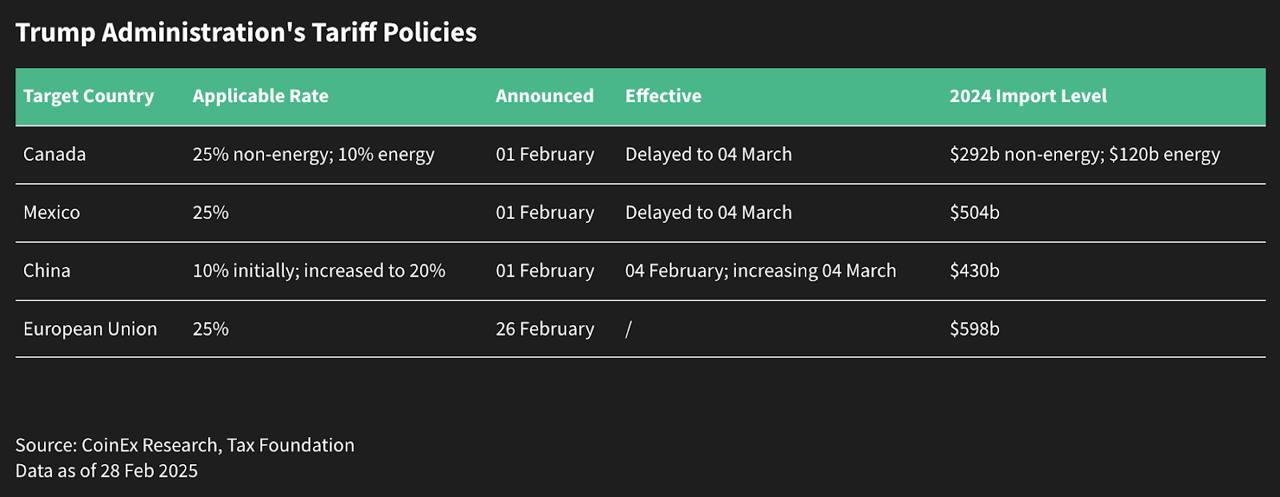

Trump’s Tariff Plans Squeeze Crypto

The cryptocurrency market’s struggles were compounded by broader macroeconomic pressures. The Trump administration’s new tariff plans raised concerns over escalating trade tensions, slower economic growth, and potential inflationary pressures. These factors spooked investors, especially in risk assets like Bitcoin, with some speculating that central banks might delay interest rate cuts or even implement rate hikes to curb inflation.

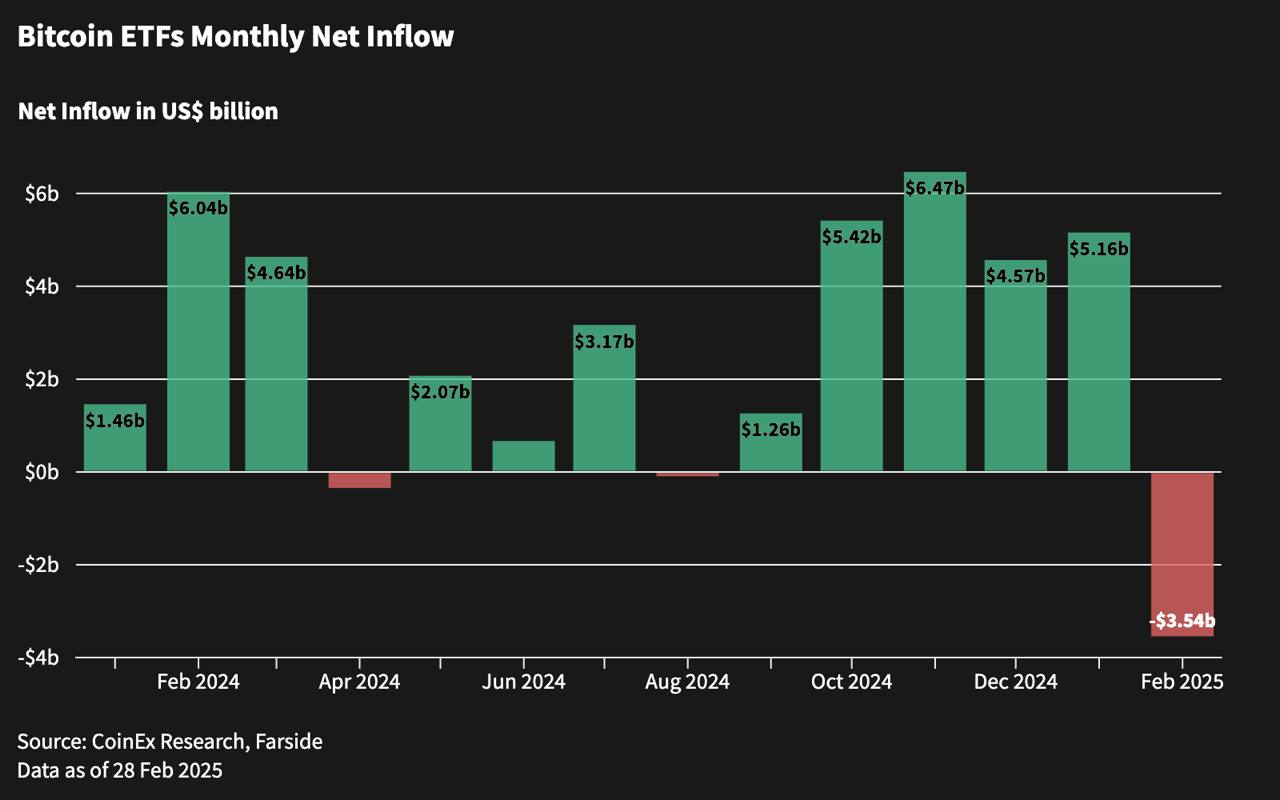

BTC ETFs Record Major Outflows

In addition to these macroeconomic factors, institutional investors also pulled back from the cryptocurrency market. February saw an unprecedented $3.5 billion in net outflows from Bitcoin ETF products, marking the largest monthly outflow since the launch of ETFs. This shift highlighted growing caution among institutional investors amidst increasing market volatility and uncertainty.

Market Scenarios: Where Do We Go From Here?

Looking ahead, the cryptocurrency market faces several potential scenarios. One possibility is a rebound after February’s sharp sell-off, driven by positive macroeconomic or industry-specific developments. Alternatively, if negative sentiment persists, Bitcoin could fall further to test support levels around $70,000, a price point not seen since before Trump’s election victory. Another potential scenario is the onset of a prolonged downtrend, with the market establishing a lower low on the weekly chart. Finally, a period of sideways consolidation may occur, allowing for a reaccumulation phase and potentially more stable support.

Political Meme Token Chaos

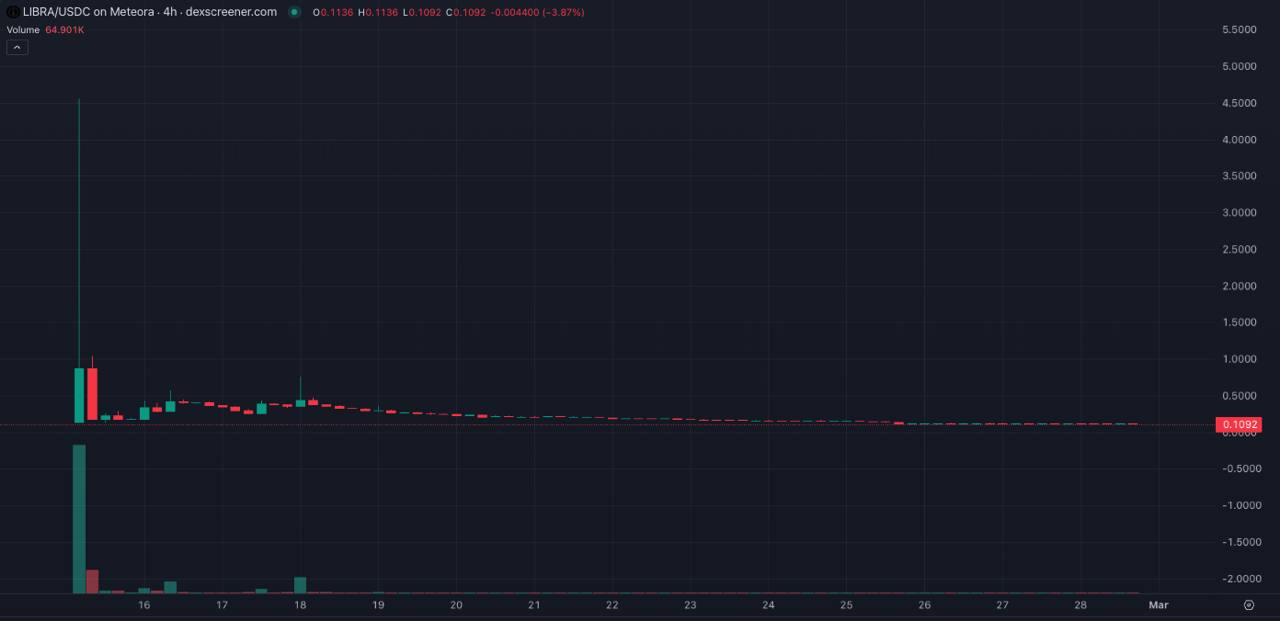

February saw a surge in political meme tokens, including the Trump and Melania tokens, as well as new entrants like the CAR and LIBRA tokens. While initially receiving significant attention, the LIBRA token quickly became embroiled in controversy. The token, which was initially launched by the President of Argentina, Javier Milei, saw its price soar, but quickly collapsed by 80% following revelations of its controversial origins. Investigations revealed links between the token’s creators and other problematic token launches, further tarnishing the reputation of political meme tokens. The fallout from LIBRA also had a severe impact on Solana’s ecosystem, leading to a major drop in the price of Solana’s native assets.

Source: Dex Screener

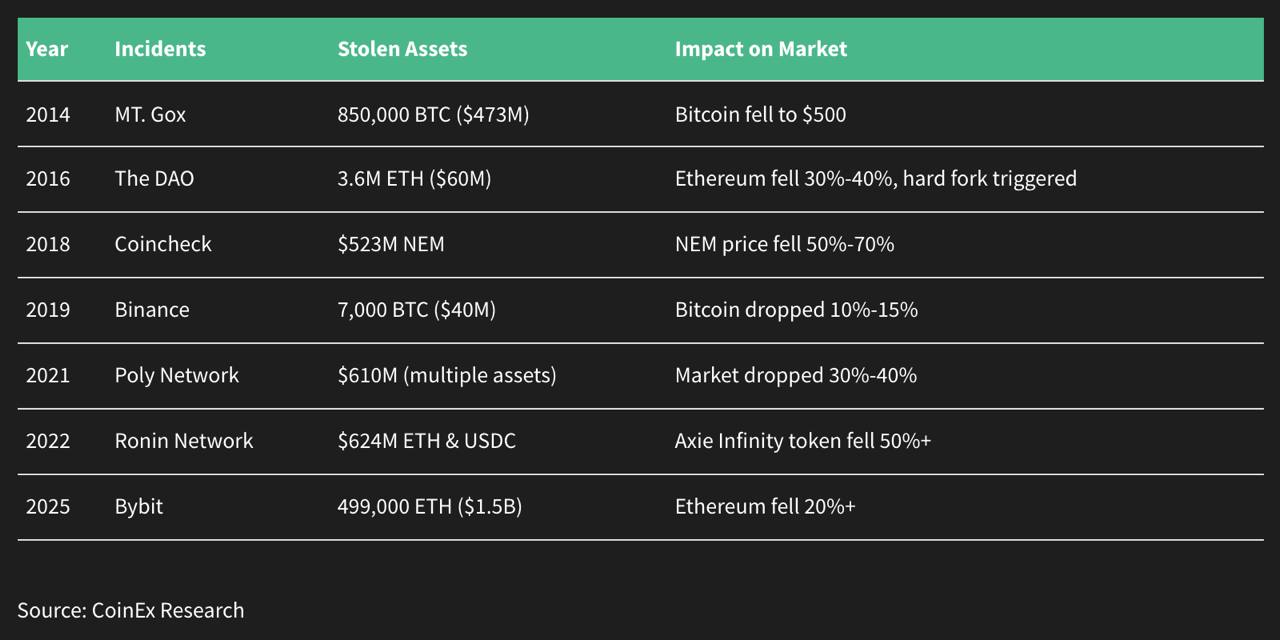

Bybit’s Historic Hack

A major security breach at Bybit, one of the leading centralized cryptocurrency exchanges. Hackers stole over 490,000 ETH, valued at approximately $1.5 billion, making it one of the largest exchange hacks in history. The stolen funds were laundered through various channels, exacerbating market volatility. Ethereum’s price dropped from $2,700 to $2,100 in the wake of the hack, reflecting heightened investor anxiety. This event not only impacted Bybit but also eroded confidence in centralized exchanges (CEXs) more broadly, causing downward pressure on other platforms.

Another “Bear” Just Came: Berachain’s Mainnet Launch

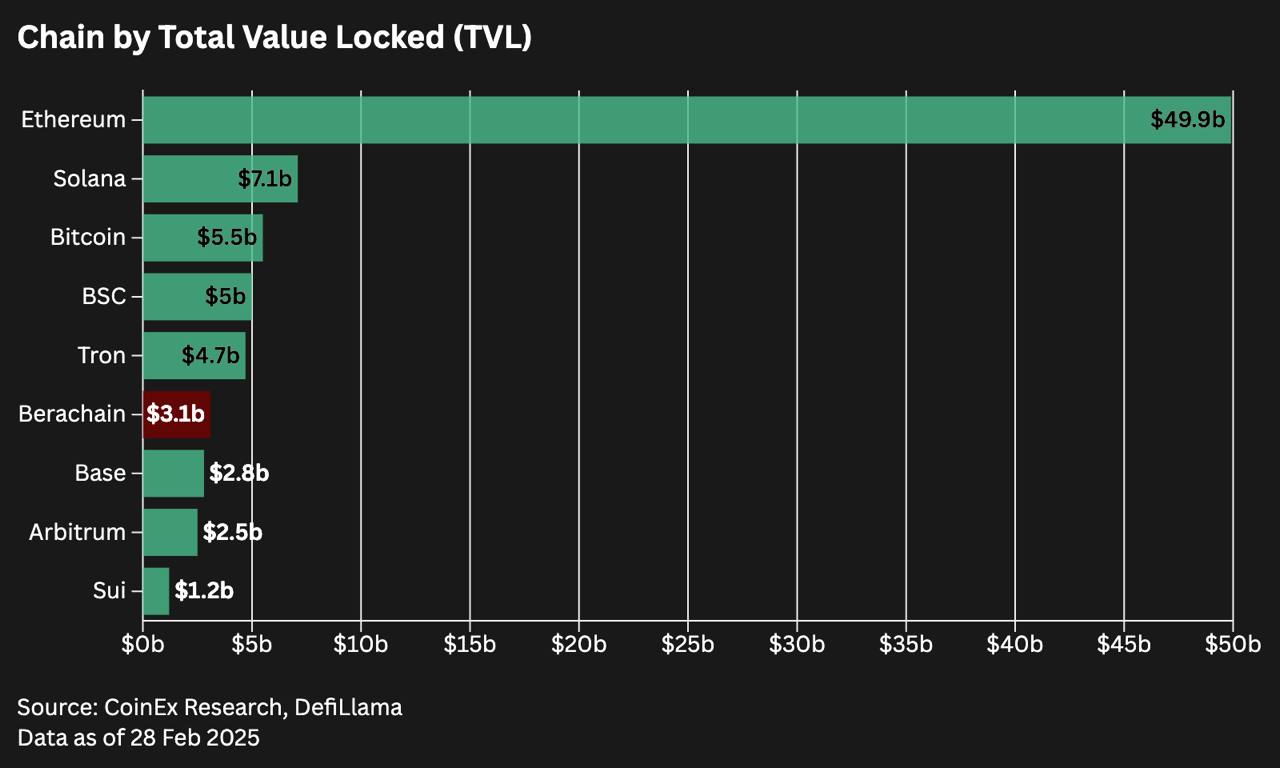

Ironically, the bearish sentiment coincided with the launch of Berachain’s mainnet, an Ethereum-compatible Layer 1 blockchain built on the Cosmos SDK. Berachain’s launch was met with impressive success, listing over 110 projects and securing $2.6 billion in pre-deposits through its Royco initiative. With a TVL exceeding $3.1 billion, Berachain has rapidly ascended to become the sixth-largest blockchain by TVL, demonstrating strong early traction despite the broader market downturn.

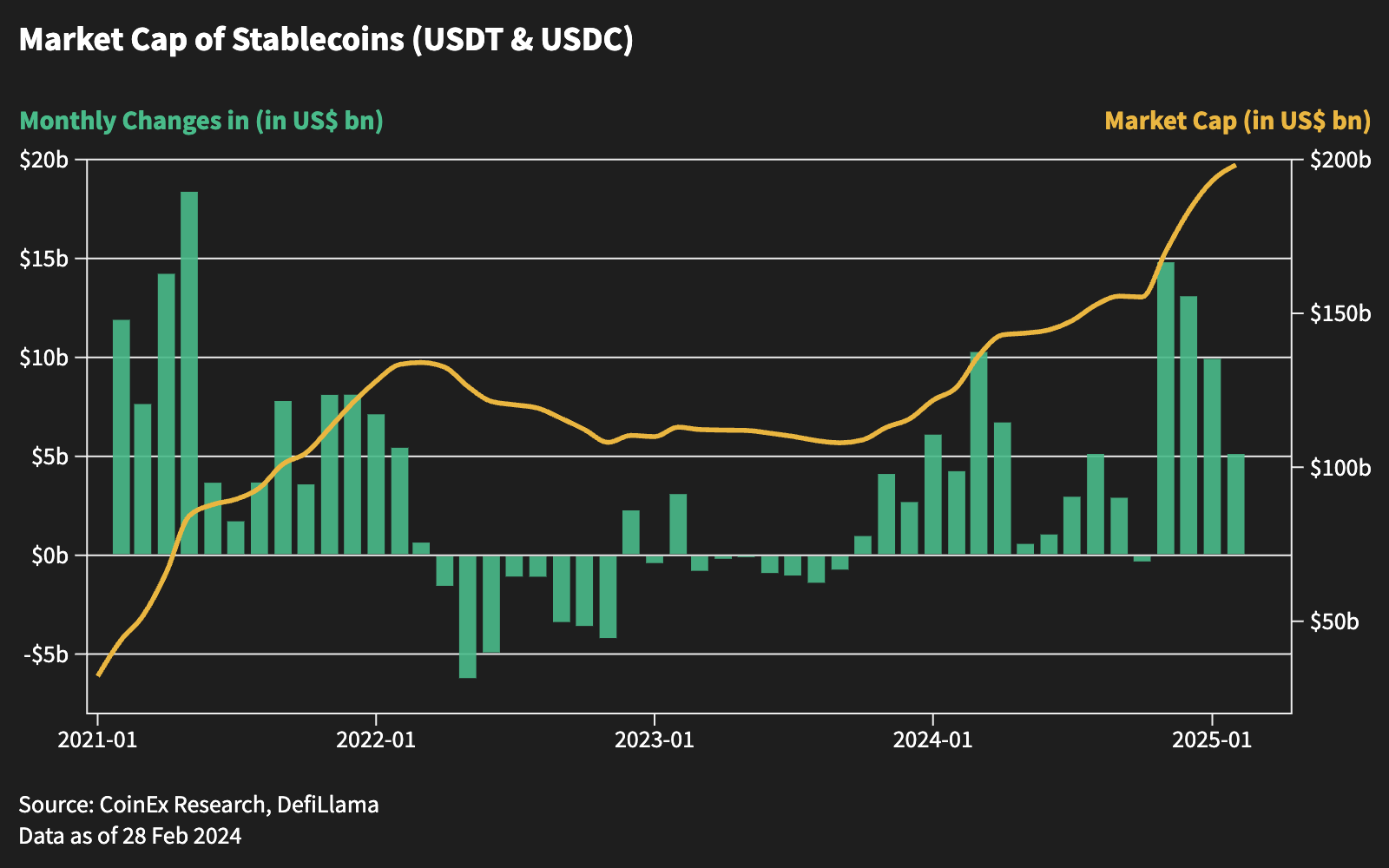

Stablecoin Inflows Remain Resilient

Despite the market’s challenges, stablecoin inflows showed resilience. February’s net inflow of $5 billion, although lower than January’s $9.9 billion, still suggests that liquidity remains robust. This deceleration in inflows is seen as a natural response to the current risk-averse macroeconomic environment. However, stablecoin inflows continue to follow patterns typical of a bull market, indicating that the underlying structure of the market remains intact.

Conclusion

The cryptocurrency market in February 2025 was marked by significant challenges, including a sharp decline in Bitcoin’s price, heightened political turmoil, and major security breaches. However, amidst the bearish sentiment, there were signs of innovation and resilience, with Berachain’s successful launch offering a glimpse of hope. Stablecoin inflows remain strong, and the market may still have ample liquidity to weather the storm. As we move into March, the key question will be whether the market can regain its footing or if further downside is inevitable.

About CoinEx

Established in 2017, CoinEx is a global cryptocurrency exchange designed with users in mind. Since its launch by the industry-leading mining pool ViaBTC, the platform has been one of the earliest crypto exchanges to release proof-of-reserves to protect 100% of user assets. CoinEx provides over 1300 cryptocurrencies, supported by professional-grade features and services, for its 10+ million users across 200+ countries and regions. CoinEx is also home to its native token, CET, which incentivizes user activities while empowering its ecosystem.

CoinEx Research remains committed to providing in-depth analyses and insights into the evolving cryptocurrency market, helping investors navigate through the complexities and opportunities that lie ahead.

To learn more about CoinEx, visit: Website | Twitter | App | Telegram | LinkedIn | Facebook | Instagram | YouTube

Contact:

Karen Hu

pr@coinex.com

Disclaimer: This content is provided by CoinEx. The statements, views, and opinions expressed in this content are solely those of the content provider and do not necessarily reflect the views of this media platform or its publisher. We do not endorse, verify, or guarantee the accuracy, completeness, or reliability of any information presented. This content is for informational purposes only and should not be considered financial, investment, or trading advice. Investing in crypto and mining related opportunities involves significant risks, including the potential loss of capital. Readers are strongly encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. However, due to the inherently speculative nature of the blockchain sector–including cryptocurrency, NFTs, and mining–complete accuracy cannot always be guaranteed. Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/d04b0063-4408-4048-ba77-cd0cc8509b2c

https://www.globenewswire.com/NewsRoom/AttachmentNg/fdd2c71d-1560-4fd3-a72a-2582bb8ebfae

https://www.globenewswire.com/NewsRoom/AttachmentNg/8727137f-6a77-4d79-ab61-2e7187615512

https://www.globenewswire.com/NewsRoom/AttachmentNg/ad9dacaf-790e-43a3-b6b1-b3e65879f631

https://www.globenewswire.com/NewsRoom/AttachmentNg/402882e0-0b53-4184-a240-e630e83c8a86

https://www.globenewswire.com/NewsRoom/AttachmentNg/b8d57632-a75d-4f86-b32f-1d9dc4e5ef0c

https://www.globenewswire.com/NewsRoom/AttachmentNg/ba54e013-928a-473c-9e5f-4e3bc9f541e6

https://www.globenewswire.com/NewsRoom/AttachmentNg/6f4ab9f8-bf3a-4ef5-bcc5-5f06d82e1a37

![]()