Growth in financial market participation & Rising demand for real-time data processing drives growth in the high-frequency trading server market.

Pune, Oct. 16, 2024 (GLOBE NEWSWIRE) — Market size & Growth Analysis:

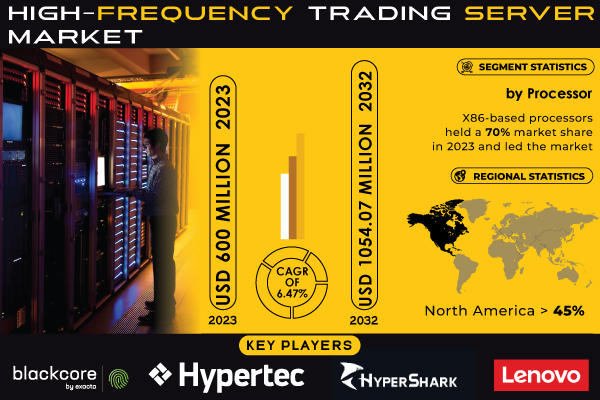

As per the SNS Insider Report,“The High-frequency Trading Server Market was valued at USD 600 Million in 2023 and is expected to reach USD 1054.07 Million by 2032, growing at a CAGR of 6.47% over the forecast period 2024-2032.

The high-frequency trading server market is an essential part of financial technology as advanced algorithms and a high degree of connectivity today are constantly evolving trading strategies. High-frequency trading requires high-capacity server infrastructure that can ensure the processing of large amounts of data in the shortest possible time. For this reason, such servers are equipped with custom hardware including FPGAs, and ASICs which increase the efficiency of such servers and reduce the speed of trading execution. An example of this is the company Bitmain Technologies, famous in the cryptocurrency industry, which has released specific integrated circuits widely known as ASICs. Graphic cards and central processing units have also been attempted to be used in high-frequency servers, however, they are not fast enough. For Example, Bitmain’s ASICs should be mentioned, and its competitive advantage in high-frequency trading due to the complexity of algorithms, and the speed of their processing crucial in the process. Colocation services are another part of the high-frequency server market that emerged entirely due to extreme speed requirements with traders locating their servers near exchange data centers to outmatch competitors. World financial markets’ continuously increasing number of trades is one of the main factors that drive the high-frequency trading server market as in the United States, by early 2024, more than 65% of the equity market will be electronically traded.

Get a Sample Report of High-frequency Trading Server Market Forecast @ https://www.snsinsider.com/sample-request/2947

Top Market Players Listed in this Research Report are:

- ASA Computers, Inc. (ASA SuperServer, ASA High-Performance Trading Workstation)

- Blackcore Technologies (Blackcore HFT Server, Blackcore Ultra-Low Latency Platform)

- Hypertec (Hypertec High-Performance Computing Server, Hypertec Ultra-Low Latency Solution)

- Dell (Dell PowerEdge R940 Rack Server, Dell EMC PowerEdge C6420)

- HP Enterprise Development LP (HPE ProLiant DL380 Gen10 Server, HPE Apollo 6000 System)

- Hypershark Technologies (Hypershark HFT Optimized Server, Hypershark Low-Latency Trading Platform)

- Lenovo (Lenovo ThinkSystem SR670, Lenovo System x3650)

- Penguin Computing (Penguin Altus HFT Server, Penguin Computing Blade System)

- Super Micro Computer, Inc. (Supermicro SuperServer 1029U, Supermicro Ultra SuperServer)

- Tyrone Systems (Tyrone Ultra-Low Latency Server, Tyrone Trading Appliance)

- XENON Systems Pty Ltd (XENON Performance Server, XENON Trading Node)

- Intel Corporation (Intel Xeon Scalable Processors, Intel FPGA for HFT)

- IBM (IBM Power System AC922, IBM z15)

- Cisco Systems (Cisco Nexus 9000 Series, Cisco Unified Computing System)

- AMD (AMD EPYC 7003 Series, AMD Ryzen Threadripper PRO)

- Micron Technology (Micron DDR4 DRAM, Micron SSD for Low Latency)

- Arista Networks (Arista 7500R Series, Arista 7280R Series)

- Fujitsu (Fujitsu PRIMERGY RX2540 M5, Fujitsu SPARC M12)

- Tyan Computer Corp. (Tyan Thunder HX FT77B-B7109, Tyan GT62B-B7117)

- Hewlett Packard Enterprise (HPE) (HPE ProLiant DL325 Gen10, HPE Synergy)

“Market Segment Insights: Detailed Analysis Reveals Strategic Growth Pathways”

By Processor: X86-based processors held a 70% market share in 2023 and led the market for its well-established architecture, good efficiency, and wide range of available software. Such chips from Intel and AMD offer fast clock speeds and multiple-core workflows. Therefore, they suit HFT the best by running complicated algorithms and requiring minimum latency in program operation. Another reason for their leading position on the market would be the fact that they may be run on virtually any trading software and environment, making them the customers’ first choice.

By Form Factor: The 2U form factor dominated the market with its 40% market share in 2023. It offers a compromise between size, energy efficiency, and heat emission, which is crucial for high-frequency trading. Such servers often come with the necessary support to hold several central processing units and large amounts of RAM as well as multi-queue networking interfaces to achieve the best trade execution and optimal handling of load when processing information about markets.

Do you Have any Specific Queries or Need any Customize Research on High-frequency Trading Server Market, Request for Analyst Call @ https://www.snsinsider.com/request-analyst/2947

Key Market Segments:

By Processor

- X-86-based

- ARM-based

- Non-x86-based

By Form Factor

- 1U

- 2U

- 4U

- Others

By Application

- Equity Trading

- Forex Markets

- Commodity Markets

- Others

“Regional Analysis Overview: Unveiling Market Landscape and Trends”

In 2023, North America led the market with a 45% share, due to the presence of major financial institutions, hedge funds, and proprietary trading firms. In addition, the presence of cutting-edge technological infrastructure ensures that trade can be conducted efficiently in this region. Moreover, the guaranteed quick response time and connections are integral components to ensuring the smooth execution of high-frequency trades. Furthermore, New York City is home to the major stock exchanges and serves as a global financial hub. The associated investments have enabled the majority of trade-related technologies to be deployed in this region.

Asia-Pacific region is anticipated to have the fastest CAGR during 2024-2032. The increasing market liberation, technological development, and growing reliance on algorithmic trading have fueled the need for rapid growth. Japan, China, and Australia, among other countries, are fast becoming significant players in the HFT sector in the Asia-Pacific region. Furthermore, the stock markets of these countries are attempting to upgrade their technologies to attract global traders.

Recent Developments

| Date | Company | Development/Launch |

| July 2024 | IBM | Launched a new generation of ultra-low latency trading servers, optimized for algorithmic trading. |

| May 2024 | Dell | Released high-performance servers for HFT, featuring enhanced processing speeds and reduced latency. |

| March 2024 | Lenovo | Announced a new ARM-based trading server designed for faster processing in emerging financial markets. |

Purchase an Enterprise User License of High-frequency Trading Server Market Report at 40% Discount @ https://www.snsinsider.com/checkout/2947

Future Trends for the High-frequency Trading Server Market

- Shift towards cloud-based HFT solutions: As cloud technology continues to develop and demonstrate significant use cases, a growing number of firms are likely to adopt hybrid models, where they supplement their on-premises servers with cloud-based high-frequency trading servers to achieve an inseparable balance between performance and placement and reduce costs.

- Increased focus on AI and machine learning: As more systems continue to achieve the ‘thinking’ paradigm, much like humans or even better, some firms are devoted to integrating AI in their trading servers. The enhancements allow firms to predict market trends and perform transactions faster thereby driving the demand for more advanced processing servers.

- Development of quantum computing: Although it remains in the early stages of development, the emergence of quantum computing is seen as transforming high-frequency trading, where its speed will become relatively more unimaginable. As a result, quantum computing is likely to become one of the areas constituting the future growth of HFT servers.

- Increasing investments in more data centers: With the expansion of data centers in key financial and technology hubs, the demand for high-frequency trading servers that are capable of processing huge amounts of data at low latency to assist faster trading will grow.

Table of Contents – Key Points Analysis

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 High-frequency Trading Server Key Vendors and Feature Analysis, 2023

5.2 High-frequency Trading Server Performance Benchmarks, 2023

5.3 High-frequency Trading Server Integration Capabilities, by Software

5.4 Usage Statistics, 2023

6. Competitive Landscape

7. High-frequency Trading Server Market Segmentation, by Processor

8. High-frequency Trading Server Market Segmentation, by Form Factor

9. High-frequency Trading Server Market Segmentation, by Application

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Insights of High-frequency Trading Server Market Growth & Outlook 2024-2032@ https://www.snsinsider.com/reports/high-frequency-trading-server-market-2947

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Akash Anand – Head of Business Development & Strategy info@snsinsider.com Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

![]()