Riot Produces 322 Bitcoin in August 2024 and Exceeds 10,000 Bitcoin Held

CASTLE ROCK, Colo., Sept. 5, 2024 /PRNewswire/ — Riot Platforms, Inc. (NASDAQ: RIOT) (“Riot” or “the Company”), an industry leader in vertically integrated Bitcoin (“BTC”) mining, announces unaudited production and operations updates for August 2024.

|

Bitcoin Production and Operations Updates for August 2024

|

||||||||

|

Comparison (%) |

||||||||

|

Metric |

August 2024 1 |

July 2024 1 |

August 2023 |

Month/Month |

Year/Year |

|||

|

Bitcoin Produced |

322 |

370 |

333 |

-13 % |

-3 % |

|||

|

Average Bitcoin Produced per Day |

10.4 |

11.9 |

10.8 |

-13 % |

-3 % |

|||

|

Bitcoin Held 2 |

10,019 |

9,704 |

7,309 |

3 % |

37 % |

|||

|

Bitcoin Sold |

– |

– |

300 |

N/A |

N/A |

|||

|

Bitcoin Sales – Net Proceeds |

– |

– |

$8.6 million |

N/A |

N/A |

|||

|

Average Net Price per Bitcoin Sold |

N/A |

N/A |

$28,617 |

N/A |

N/A |

|||

|

Deployed Hash Rate – Rockdale 2 |

14.7 EH/s |

14.7 EH/s |

10.3 EH/s 2 |

0 % |

42 % |

|||

|

Deployed Hash Rate – Corsicana 2 |

7.6 EH/s |

7.6 EH/s |

– |

0 % |

N/A |

|||

|

Deployed Hash Rate – Kentucky 2,3 |

1.2 EH/s |

1.0 EH/s |

N/A |

20 % |

N/A |

|||

|

Deployed Hash Rate – Total 2 |

23.5 EH/s |

23.2 EH/s |

10.3 EH/s |

1 % |

128 % |

|||

|

Avg. Operating Hash Rate – Rockdale 4 |

8.2 EH/s |

9.6 EH/s |

4.5 EH/s |

-14 % |

84 % |

|||

|

Avg. Operating Hash Rate – Corsicana 4 |

5.2 EH/s |

5.7 EH/s |

– |

-9 % |

N/A |

|||

|

Avg. Operating Hash Rate – Kentucky 3,4 |

1.0 EH/s |

0.9 EH/s 5 |

N/A |

16 % |

N/A |

|||

|

Avg. Operating Hash Rate – Total 4 |

14.5 EH/s |

15.5 EH/s |

4.5 EH/s |

-7 % |

224 % |

|||

|

Power Credits 6 |

$5.7 million |

$3.2 million |

$23.3 million |

79 % |

-76 % |

|||

|

Demand Response Credits 7 |

$0.7 million |

$0.2 million |

$5.2 million |

261 % |

-86 % |

|||

|

Total Power Credits |

$6.4 million |

$3.4 million |

$28.5 million |

90 % |

-78 % |

|||

|

All-in Power Cost – Rockdale 8 |

2.0c/kWh |

3.0c/kWh |

(15.8)c/kWh |

-17 % |

N/M |

|||

|

All-in Power Cost – Corsicana 8 |

3.9c/kWh |

3.9c/kWh |

N/A |

1 % |

N/A |

|||

|

All-in Power Cost – Kentucky 8,9 |

3.7c/kWh |

3.6c/kWh 10 |

N/A |

4 % |

N/A |

|||

|

All-in Power Cost – Total 8 |

2.6c/kWh |

3.2c/kWh |

(15.8)c/kWh |

-14 % |

N/M |

|||

|

|

||||||||

“August is historically the hottest month of the year in Texas, resulting in some of the highest periods of demand on the ERCOT grid,” said Jason Les, CEO of Riot. “In August, Riot produced 322 Bitcoin and continued to exercise our unique power strategy, ensuring that we optimized our energy costs while making more power available to the grid during periods of peak demand. As a result, Riot generated power credits in August that led to an all-in power cost at our Rockdale Facility of $20/MWh, while our Corsicana Facility, which purchases energy at the real-time spot price, achieved an all-in power cost for the month of $39/MWh.

“In addition to periods of curtailment due to our participation in demand response programs, uptime was impacted during the month by high temperatures in Texas and unscheduled maintenance at one of the buildings at our Rockdale Facility, which has subsequently returned to full operation. At our Corsicana Facility, building cooling systems in Buildings A1 and A2 were being completed towards the end of August, and on completion, this will alleviate the impact of high temperatures on our operations at A1 and A2 going forward.

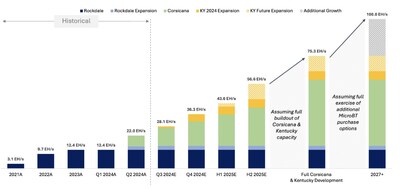

“We have made significant progress towards completing the development of our third 100 MW building at the Corsicana Facility, Building B1, and the deployment of miners within it, which will be completed and operating at full capacity by the end of September. We have also begun to increase hash rate at our newly acquired Kentucky facilities, where additional capacity growth is ongoing, and we remain on track to achieve our third quarter hash rate target of 28 EH/s and year-end hash rate growth target of 36 EH/s.”

Riot’s Power Strategy Overview

Riot’s power strategy is based on being a flexible consumer of power. The Company typically consumes power when it is low-cost and abundant, as opposed to residential consumers, who typically increase power usage during peak periods of demand. When demand increases and/or supply decreases, causing prices to rise, the Company can either power down to reduce power costs, or bid competitively to provide the grid operator with visibility into, and control over, Riot’s power utilization. This control gives the grid operator the ability to either absorb excess power when supply is high or to curtail Riot’s operations in order to reduce demand when beneficial to the grid, and ultimately, to all consumers.

During August, Riot continued its participation in ERCOT’s Four Coincident Peak Program (“4CP”). The 4CP program is an opportunity for users of power to curtail usage during periods of highest demand on the grid in each of the four summer months of the year. Riot curtailed operations in August during peak periods of demand within ERCOT and will continue to do so throughout the summer. These periods of curtailment occur whenever total demand on the grid could reach its peak point for each month and does not depend on the current price for power, which fluctuates due to a variety of factors and may be lower or higher than anticipated. As part of Riot’s participation in this voluntary program, the Company can achieve substantial savings on future costs, and participation is a key part of the Company’s partnership-driven approach with the grid and all consumers of power in ERCOT.

Infrastructure Update

Riot is currently developing Phase 1 (400 MW) of the Company’s Corsicana Facility, which, once fully developed, is expected to total 1 gigawatt (1,000 MW) in developed mining capacity.

Riot continued development of the third 100 MW building, Building B1, and began deploying miners within the building. Building B1 will be fully operational in the month of September. Development has continued on the final 100 MW building in Phase 1, Building B2, and miner deployment will begin during the month of September.

Estimated Hash Rate Growth

Investor Events

- H.C. Wainwright 26th Annual Global Investment Conference September 9-11th in New York City.

Human Resources Update

Riot is currently recruiting for positions across the Company. Join our team in building, expanding, and securing the Bitcoin network.

Open positions are available at: https://www.riotplatforms.com/careers.

About Riot Platforms, Inc.

Riot’s (NASDAQ: RIOT) vision is to be the world’s leading Bitcoin-driven infrastructure platform. Our mission is to positively impact the sectors, networks, and communities that we touch. We believe that the combination of an innovative spirit and strong community partnership allows the Company to achieve best-in-class execution and create successful outcomes.

Riot is a Bitcoin mining and digital infrastructure company focused on a vertically integrated strategy. The Company has Bitcoin mining operations in central Texas and Kentucky, and electrical switchgear engineering and fabrication operations in Denver, Colorado.

For more information, visit www.riotplatforms.com.

Safe Harbor

Statements in this press release that are not historical facts are forward-looking statements that reflect management’s current expectations, assumptions, and estimates of future performance and economic conditions. Such statements rely on the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Words such as “anticipates,” “believes,” “plans,” “expects,” “intends,” “will,” “potential,” “hope,” and similar expressions are intended to identify forward-looking statements. These forward-looking statements may include, but are not limited to, statements about the benefits of acquisitions, including financial and operating results, and the Company’s plans, objectives, expectations, and intentions. Among the risks and uncertainties that could cause actual results to differ from those expressed in forward-looking statements include, but are not limited to: unaudited estimates of Bitcoin production; our future hash rate growth (EH/s); the anticipated benefits, construction schedule, and costs associated with the development of our mining facilities in Texas, Kentucky and elsewhere; our expected schedule of new miner deliveries; the impact of weather events on our operations and results; our ability to successfully deploy new miners; the variance in our mining pool rewards may negatively impact our results of Bitcoin production; megawatt (“MW”) capacity under development; we may not be able to realize the anticipated benefits from immersion cooling; the integration of acquired businesses may not be successful, or such integration may take longer or be more difficult, time-consuming or costly to accomplish than anticipated; failure to otherwise realize anticipated efficiencies and strategic and financial benefits from our acquisitions; and the impact of COVID-19 on us, our customers, or on our suppliers in connection with our estimated timelines. Detailed information regarding the factors identified by the Company’s management which they believe may cause actual results to differ materially from those expressed or implied by such forward-looking statements in this press release may be found in the Company’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including the risks, uncertainties and other factors discussed under the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as amended, and the other filings the Company makes with the SEC, copies of which may be obtained from the SEC’s website, www.sec.gov. All forward-looking statements included in this press release are made only as of the date of this press release, and the Company disclaims any intention or obligation to update or revise any such forward-looking statements to reflect events or circumstances that subsequently occur, or of which the Company hereafter becomes aware, except as required by law. Persons reading this press release are cautioned not to place undue reliance on such forward-looking statements.

Investor Contact:

Phil McPherson

303-794-2000 ext. 110

IR@Riot.Inc

Media Contact:

Alexis Brock

303-794-2000 ext. 118

PR@Riot.Inc

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/riot-announces-august-2024-production-and-operations-updates-302238883.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/riot-announces-august-2024-production-and-operations-updates-302238883.html

SOURCE Riot Platforms, Inc.

![]()