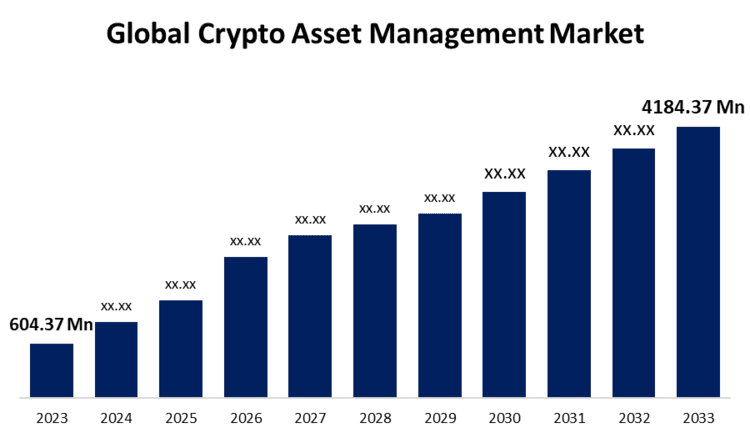

The Global Crypto Asset Management Market Size was Valued at USD 604.37 Million in 2023 and the Worldwide Crypto Asset Management Market Size is Expected to Reach USD 4184.37 Million by 2033, according to a research report published by Spherical Insights & Consulting. Companies covered:Coinbase Gemini Trust Company Crypto Finance Group Vo1t Ltd, Bakkt BitGo Ledger SAS METACO ICONOMI Limited Exodus Movement Xapo Holdings Limited Paxos Trust Company Amberdata Others

New York, United States , July 15, 2024 (GLOBE NEWSWIRE) — The Global Crypto Asset Management Market Size is to Grow from USD 604.37 Million in 2023 to USD 4184.37 Million by 2033, at a Compound Annual Growth Rate (CAGR) of 21.35% during the projected period.

Get a Sample PDF Brochure: https://www.sphericalinsights.com/request-sample/5025

A crypto asset management platform is specialized software designed to streamline the processes involved in buying, trading, and keeping bitcoins. With the aid of crypto asset management, users may manage several cryptocurrency assets on a single platform. As more individuals invest in many accounts and wallets, there is an increasing demand for integrated portfolio management solutions. It is projected that this would lead to a rise in the need for crypto asset management services and solutions. The asset management system is being used by both new and experienced investors to learn about the constantly changing virtual currency market. Globally, cryptocurrency users are growing increasingly interested in the answer. The market carries a great deal of financial danger, much like this. To lessen and manage these substantial risks, consumers are turning to bitcoin asset management solutions. In addition, as society becomes more globalized, there is a noticeable increase in the demand for internet traction. This is having a favorable impact on the adoption of crypto-asset management, which opens up huge prospects for investors. Furthermore, with the introduction of blockchain, the global cryptocurrency market is growing rapidly. Blockchain can provide very high security for digital assets and cryptocurrencies. When using blockchain technology, users can approve transactions without requiring permission from a central authority. Among the primary uses of blockchain are smart contracts, voting, and fund exchange. Blockchain has a broad range of applications in every business. Furthermore, financial institutions are looking at the idea of using blockchain technology to move and store digital assets, such as cryptocurrencies, around the internet ecosystem. The availability of blockchain technology, which is fueling the growth of cryptocurrencies, will increase demand for crypto asset management solutions globally. However, a lack of understanding of cryptocurrencies’ uses and insufficient technological expertise in transaction processing are the primary barriers to their broad use.

Browse key industry insights spread across 219 pages with 110 Market data tables and figures & charts from the report on the “Global Crypto Asset Management Market Size, Share, and COVID-19 Impact Analysis, By Solution (Custodian Solutions and Wallet Management), By Application (Web-Based and Mobile), By Deployment Mode (Cloud and On-Premises), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.”

Buy Now Full Report: https://www.sphericalinsights.com/checkout/5025

The custodian solutions segment is anticipated to hold the greatest share of the global crypto asset management market during the projected timeframe.

Based on the solution, the global crypto asset management market is divided into custodian solutions and wallet management. Among these, the custodian solutions segment is anticipated to hold the greatest share of the global crypto asset management market during the projected timeframe. Custodian solutions, with their capacity to oversee digital assets and provide secure storage on behalf of investors, are essential to the industry. Investors require reliable custodial services with robust security features, such as multi-signature authentication and offline storage, as cryptocurrencies grow in value and sophistication. Well-known custodians and financial institutions are leveraging their experience in traditional asset custody to enter the global crypto asset management sector to address the growing demand for secure storage and institutional-grade custodial services.

The mobile segment is expected to grow at the fastest CAGR in the global crypto asset management market during the projected timeframe.

Based on the application, the global crypto asset management market is divided into web-based and mobile. Among these, the mobile segment is expected to grow at the fastest CAGR in the global crypto asset management market during the projected timeframe. Due to their convenience and the fact that more people are using smartphones, mobile applications have become more and more popular with bitcoin investors. With mobile-based crypto asset management apps, users can access their digital assets anytime, anywhere, and manage their investments, transactions, and portfolios. The domination of this specific market segment can be attributed to the ease of use, push alerts, and availability of real-time market data found in mobile applications, which are popular among investors.

The on-premises segment is predicted for the largest revenue share in the global crypto asset management market during the estimated period.

Based on the deployment mode, the global crypto asset management market is divided into cloud and on-premises. Among these, the on-premises segment is predicted for the largest revenue share in the global crypto asset management market during the estimated period. Large organizations typically see the on-premise deployment option favorably since it offers the advantage of improved security over cloud deployment and the capacity to install software on the organization’s own IT infrastructure. Crypto asset management systems come in platform and standalone varieties, and they are usually implemented in end-user locations. They have total control over the hardware, software, data, maintenance, and support that the solution providers supply. All operational duties, including setup, configuration, maintenance, and solution deployment, are completed locally, on the end-user’s property.

Inquire Before Buying This Research Report: https://www.sphericalinsights.com/inquiry-before-buying/5025

North America is expected to hold the largest share of the global crypto asset management market over the forecast period.

North America is expected to hold the largest share of the global crypto asset management market over the forecast period. This is due to several things, including the growth of the economy and the introduction of new industries. The introduction and early adoption of the solution are driving the market potential in the region. Furthermore, several renowned businesses in the area offer customized solutions for each sector of the economy. In addition, a large number of cloud crypto solution providers in the US and Canada are expected to create lucrative opportunities for the industry.

Asia Pacific is predicted to grow at the fastest pace in the global crypto asset management market during the projected timeframe. Asia Pacific is emerging as a center for the development and adoption of virtual currencies. Countries that have adopted blockchain technology early on include Singapore, South Korea, China, Japan, and others. These countries have shown a strong interest in cryptocurrencies. With its substantial population and high level of technological advancement, the region is perfect for the growth of cryptocurrency asset management companies. The market’s growth is also being fueled by the rise in cryptocurrency exchanges and startups in the Asia Pacific region as well as the increasing participation of Asian institutional investors.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Major vendors in the Global Crypto Asset Management Market include Coinbase, Gemini Trust Company, Crypto Finance Group, Vo1t Ltd, Bakkt, BitGo, Ledger SAS, METACO, ICONOMI Limited, Exodus Movement, Xapo Holdings Limited, Paxos Trust Company, Amberdata, and Others.

Get Discount At @ https://www.sphericalinsights.com/request-discount/5025

Recent Developments

- In March 2021, Gemini Fund Solutions, a full range of Bitcoin fund services for fund managers, was introduced by Gemini Trust Company, LLC. On a single platform, the system provides clearing, custody, trade execution, and other capital markets services.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Crypto Asset Management Market based on the below-mentioned segments:

Global Crypto Asset Management Market, By Solution

- Custodian Solutions

- Wallet Management

Global Crypto Asset Management Market, By Application

- Web-Based

- Mobile

Global Crypto Asset Management Market, By Deployment Mode

- Cloud

- On-Premises

Global Crypto Asset Management Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Browse Related Reports

Global Medical Equipment Financing Market Size, Share, and COVID-19 Impact Analysis, By Equipment (Diagnostics Equipment, Therapeutic Equipment, Patient Monitoring Equipment, Laboratory Equipment, and Medical Furniture), By Type (New Medical Equipment, Rental Equipment, and Refurbished Equipment), By End User (Hospitals & Clinics, Laboratories & Diagnostic Centers, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Security Brokerage and Stock Exchange Market Size, Share, and COVID-19 Impact Analysis, By Type (Stock Exchanges, Derivatives & Commodities Brokerage, Equities Brokerage, Bonds Brokerage, and Others), By Establishment Type (Investment Firms, Banks, and Exclusive Brokers), By Mode (Online and Offline), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Regtech Market Size, Share, and COVID-19 Impact Analysis, By Component (Solutions and Services), By Application (Anti-Money Laundering (AML) & Fraud Management, Regulatory Intelligence, Risk & Compliance Management, and Regulatory Reporting), By Deployment Mode (On-Premises and Cloud-Based), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Crypto Asset Management Market Size, Share, and COVID-19 Impact Analysis, By Solution (Custodian Solutions and Wallet Management), By Application (Web-Based and Mobile), By Deployment Mode (Cloud and On-Premises), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company’s mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

![]()