New York, NY, March 28, 2025 (GLOBE NEWSWIRE) — Bitcoin’s recent price retreat has created a strategic entry point, according to Tide Capital, as recession risks and institutional dynamics signal a potential market bottom. Despite macroeconomic headwinds, the firm highlights a confluence of technical and fundamental indicators pointing to a golden opportunity for long-term investors.

U.S. Recession Risks Fuel Safe-Haven Frenzy

U.S. economic turbulence has intensified in early 2025, triggering sharp corrections across risk assets. The Nasdaq Index plunged -15% from recent highs, while Bitcoin tumbled over -25% amid flight-to-safety flows.

Tide Capital highlights data from the Atlanta Fed’s GDPNow model, which indicates that Q1 2025 U.S. real GDP growth projections have dropped sharply from 3.2% to -1.8%, signaling weak short-term economic performance.

Source: Federal Reserve Bank of Atlanta

The risk of recession has escalated amidst these growth concerns. Polymarket data cited by Tide Capital shows that the market-implied probability of a U.S. recession in 2025 has risen to 35%, an increase of 13 percentage points since the beginning of the year. This rise underscores intensifying fears of a recession and increased defensive positioning among investors.

Against this backdrop of economic weakness, Tide Capital observes a surge in demand for safe-haven assets. Goldman Sachs has recently raised its gold price target to $3,300, reflecting heightened economic uncertainty and a booming demand for risk hedges.

Market Pessimism Hits Extreme, Bottom Signals Flash

Despite experiencing sharp corrections, markets appear to have fully integrated negative expectations, according to Tide Capital. The firm points out that U.S. equity CTA short positions have reached a two-year extreme, exceeding $30 billion, as reported by Goldman Sachs. This surge in short positions signals peak bearish sentiment and suggests reduced downside risks moving forward.

The unexpected decision by the Federal Reserve during its March FOMC meeting to slow the pace of quantitative tightening—by reducing monthly Treasury roll-off caps from 25 billion to 5 billion—has significantly bolstered market confidence. This shift has contributed to a rebound in risk assets, noted Tide Capital.

Source: TradingView

While acknowledging the persistence of near-term challenges, Tide Capital emphasizes that current economic data does not indicate an inevitable crisis. With extreme pessimism already reflected in asset prices, any minor economic improvements could swiftly overturn prevailing recession narratives and ignite a robust recovery rally.

Bitcoin’s Path: Short-Term Pain, Long-Term Gain

According to data from CoinGlass, Bitcoin spot ETFs have seen five consecutive weeks of outflow since February 10, totaling $5.5 billion.

Source: CoinGlass

Despite the increased outflows indicating short-term selling pressure, Tide Capital notes that historical patterns suggest these periods often coincide with market bottoms, presenting significant long-term entry opportunities for investors.

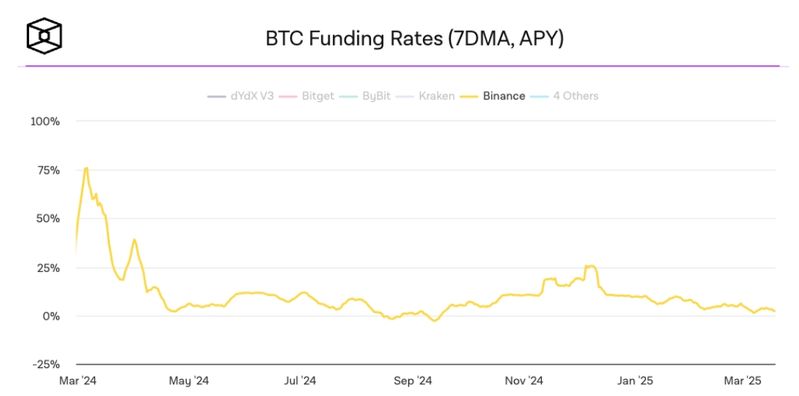

Furthermore, Tide Capital highlights that BTC perpetual funding rates on Binance have dropped below 5% (7-day average), levels not seen since September 2024, as reported by The Block. This decline in funding rates is indicative of weak bullish momentum and peak bearish sentiment—classic signs of a market bottom forming.

Source: The Block

Moreover, despite BTC’s current price being off its highs, stablecoin supplies continue to break records, surpassing 230 billion—a 30 billion increase since the start of 2025. As the backbone of liquidity within the crypto markets, the expansion of stablecoin reserves signals institutional readiness to capitalize on the next upcycle, providing fuel for future growth.

Conclusion: Strategic Entry Window Opens

Tide Capital concludes that BTC’s current environment—marked by depressed funding rates, crowded shorts, and stablecoin accumulation—creates a rare buying opportunity. “Any macro improvement or policy catalyst could trigger simultaneous short squeezes and capital inflows, propelling prices into a new upward cycle,” the firm emphasized.

Disclaimer: This press release may contain forward-looking statements. Forward-looking statements describe future expectations, plans, results, or strategies (including product offerings, regulatory plans and business plans) and may change without notice. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements.

CONTACT: Amber Kim amber-at-tidecap.com

![]()