[Latest] Global Payment Orchestration Platform Market Size/Share Worth USD 6.97 Billion by 2032 at a 25.6% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

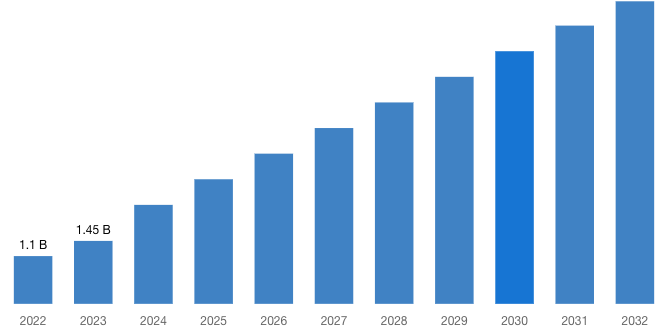

[220+ Pages Latest Report] According to a market research study published by Custom Market Insights, the demand analysis of Global Payment Orchestration Platform Market size & share revenue was valued at approximately USD 1.10 Billion in 2022 and is expected to reach USD 1.45 Billion in 2023 and is expected to reach around USD 6.97 Billion by 2032, at a CAGR of 25.6% between 2023 and 2032. The key market players listed in the report with their sales, revenues and strategies are Adyen N.V., Stripe Inc., Braintree (a PayPal Service), Checkout.com, Global Payments Inc., Fiserv Inc., Ingenico Group (acquired by Worldline), Square Inc., 2Checkout (now Verifone), Ayden Payments B.V., BlueSnap Inc., PPRO Financial Ltd., Tipalti Ltd., Citcon Inc., Celero Commerce, and others.

Austin, TX, USA, Jan. 16, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Payment Orchestration Platform Market Size, Trends and Insights By Type (Payment Gateway, Payment Processor, Payment Aggregator), By Deployment (On-premise, Cloud-based), By End-User (Retail, E-commerce, Hospitality, Healthcare, Others), By Transaction Type (Online Payments, In-store Payments, Mobile Payments), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2023–2032” in its research database.

“According to the latest research study, the demand of global Payment Orchestration Platform Market size & share was valued at approximately USD 1.10 Billion in 2022 and is expected to reach USD 1.45 Billion in 2023 and is expected to reach a value of around USD 6.97 Billion by 2032, at a compound annual growth rate (CAGR) of about 25.6% during the forecast period 2023 to 2032.”

Click Here to Access a Free Sample Report of the Global Payment Orchestration Platform Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=36222

Payment Orchestration Platform Market: Growth Factors and Dynamics:

- Digital Revolution: The Payment Orchestration Platform market experiences substantial growth propelled by the ongoing digital revolution. As businesses transition towards digital payment ecosystems, Payment Orchestration Platforms emerge as integral facilitators, streamlining and optimizing transaction processes.

- Technological Advancements: Continuous advancements in technology underscore the functional benefits of Payment Orchestration Platforms. Renowned for their agility, scalability, and seamless integration capabilities, these platforms become essential for businesses seeking efficient and flexible payment solutions.

- Enhanced Transaction Efficiency: The unique features of Payment Orchestration Platforms, such as real-time payment routing, dynamic currency conversion, and smart transaction routing, contribute to enhancing transaction efficiency. This results in improved customer satisfaction and operational effectiveness for businesses across various sectors.

- Global Payment Landscape: Payment Orchestration Platforms play a pivotal role in the global payment landscape, providing a centralized solution for managing diverse payment methods, including cards, e-wallets, and alternative payment options. Their adaptability to local payment preferences drives market expansion.

- Compliance and Security Measures: The Payment Orchestration Platform market places a strong emphasis on compliance and security measures, addressing the increasing need for robust fraud prevention and data protection. Adherence to global regulatory standards becomes a key factor influencing platform adoption.

- Customization for Industry-specific Requirements: The versatility of Payment Orchestration Platforms allows for customization to meet industry-specific needs. Whether in e-commerce, retail, or subscription-based services, these platforms adapt to diverse business models, making them indispensable for various sectors.

- E-commerce and Retail Impact: The e-commerce and retail sectors significantly influence the market’s growth, with Payment Orchestration Platforms facilitating seamless payment experiences for online shoppers. Their role in reducing cart abandonment rates and ensuring secure transactions enhances their demand in these industries.

- Cross-border Transactions: The adoption of Payment Orchestration Platforms is accelerated by the increasing trend in cross-border transactions. Businesses benefit from the platforms’ ability to manage multiple currencies, optimize conversion rates, and mitigate the complexities of international payments.

- Financial Inclusion Initiatives: Payment Orchestration Platforms contribute to financial inclusion initiatives by bridging the gap between traditional and digital payment methods. This inclusivity aligns with the global push towards a cashless economy and facilitates access to digital financial services.

- Integration with Emerging Technologies: Beyond standard payment processing, Payment Orchestration Platforms integrate with emerging technologies like blockchain, AI, and IoT. This forward-looking approach positions them as catalysts for future payment innovations and ensures their relevance in the evolving digital landscape.

Request a Customized Copy of the Payment Orchestration Platform Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=36222

Report Scope

| Feature of the Report | Details |

| Market Size in 2023 | USD 1.45 Billion |

| Projected Market Size in 2032 | USD 6.97 Billion |

| Market Size in 2022 | USD 1.10 Billion |

| CAGR Growth Rate | 25.6% CAGR |

| Base Year | 2022 |

| Forecast Period | 2023-2032 |

| Key Segment | By Type, Deployment, End-User, Transaction Type and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Payment Orchestration Platform report is available upon request; please contact us for more information.)

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2023 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2023

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Payment Orchestration Platform report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Payment Orchestration Platform Market Report @ https://www.custommarketinsights.com/report/payment-orchestration-platform-market/

Payment Orchestration Platform Market: COVID-19 Analysis:

- Adaptability and Continuity: Amid the challenges posed by the COVID-19 pandemic, the Payment Orchestration Platform market showcases adaptability by ensuring business continuity. The surge in online transactions and the need for contactless payments drive the demand for robust payment orchestration solutions.

- Acceleration of Digital Payments: The pandemic accelerates the shift towards digital payments, and Payment Orchestration Platforms play a crucial role in supporting this transition. Businesses, recognizing the importance of agile and versatile payment solutions, turn to these platforms to meet evolving consumer preferences.

- Supply Chain Resilience: Payment Orchestration Platforms contribute to supply chain resilience by providing a secure and efficient payment infrastructure. Their role in ensuring uninterrupted financial transactions becomes increasingly vital during disruptions, solidifying their position in the digital ecosystem.

- Security and Fraud Prevention: With the rise in online transactions, the market witnesses a heightened focus on security and fraud prevention. Payment Orchestration Platforms respond by implementing advanced security measures, instilling confidence in businesses and consumers alike.

- Future-Proofing Strategies: Anticipating the continued evolution of the payment landscape, organizations invest in future-proofing strategies by leveraging Payment Orchestration Platforms. These platforms remain at the forefront, adapting to emerging technologies and market dynamics to meet the evolving needs of businesses worldwide.

Request a Customized Copy of the Payment Orchestration Platform Market Report @ https://www.custommarketinsights.com/report/payment-orchestration-platform-market/

Key questions answered in this report:

- What is the size of the Payment Orchestration Platform market and what is its expected growth rate?

- What are the primary driving factors that push the Payment Orchestration Platform market forward?

- What are the Payment Orchestration Platform Industry’s top companies?

- What are the different categories that the Payment Orchestration Platform Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Payment Orchestration Platform market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2023−2032

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Payment Orchestration Platform Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/payment-orchestration-platform-market/

Regional Analysis of the Payment Orchestration Platform Market:

North America:

- Market Overview: North America leads in adopting payment orchestration platforms, driven by the mature retail and e-commerce sectors, technological advancements, and a focus on enhancing payment experiences.

- Factors Driving Growth: Robust technological infrastructure, a highly digitized consumer landscape, and the presence of key industry players contribute to the growth of the payment orchestration platform market in North America.

Europe:

- Market Overview: Europe emphasizes the integration of payment orchestration platforms in various industries, with a focus on improving payment efficiency, and compliance, and supporting diverse payment methods.

- Factors Driving Growth: A strong regulatory framework, collaborative efforts in standardization, and a diverse business landscape contribute to the growth of the payment orchestration platform market in Europe.

Asia-Pacific:

- Market Overview: The Asia-Pacific region experiences significant growth in the payment orchestration platform market, driven by the expansion of digital payments, increasing e-commerce activities, and the adoption of advanced payment solutions.

- Factors Driving Growth: Rapid urbanization, a growing middle-class population, and government initiatives to promote digital payments contribute to the increasing demand for payment orchestration platforms in Asia-Pacific.

Latin America:

- Market Overview: Latin America shows a growing interest in adopting payment orchestration platforms, particularly in the retail and e-commerce sectors, as businesses seek to enhance payment processes and support diverse payment methods.

- Factors Driving Growth: Economic development, rising consumer preferences for digital payments, and investments in modernizing payment infrastructure contribute to the growth of the payment orchestration platform market in Latin America.

Middle East and Africa:

- Market Overview: The Middle East and Africa witness an increasing adoption of payment orchestration platforms in sectors such as hospitality, healthcare, and retail, driven by a focus on digital transformation and enhancing customer experiences.

- Factors Driving Growth: Government initiatives supporting digitalization, a push for smart city projects, and the need for efficient payment management contribute to the growth of payment orchestration technology in the Middle East and Africa.

Request a Customized Copy of the Payment Orchestration Platform Market Report @ https://www.custommarketinsights.com/report/payment-orchestration-platform-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Payment Orchestration Platform Market Size, Trends and Insights By Type (Payment Gateway, Payment Processor, Payment Aggregator), By Deployment (On-premise, Cloud-based), By End-User (Retail, E-commerce, Hospitality, Healthcare, Others), By Transaction Type (Online Payments, In-store Payments, Mobile Payments), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2023–2032” Report at https://www.custommarketinsights.com/report/payment-orchestration-platform-market/

List of the prominent players in the Payment Orchestration Platform Market:

- Adyen N.V.

- Stripe Inc.

- Braintree (a PayPal Service)

- Checkout.com

- Global Payments Inc.

- Fiserv Inc.

- Ingenico Group (acquired by Worldline)

- Square Inc.

- 2Checkout (now Verifone)

- Ayden Payments B.V.

- BlueSnap Inc.

- PPRO Financial Ltd.

- Tipalti Ltd.

- Citcon Inc.

- Celero Commerce

- Others

Click Here to Access a Free Sample Report of the Global Payment Orchestration Platform Market @ https://www.custommarketinsights.com/report/payment-orchestration-platform-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Cross-Border B2C E-commerce Market: Cross-border B2C E-commerce Market Size, Trends and Insights By Offering (In-house Brands, Assorted Brands), By Payment Method (Digital Wallets, Credit/Debit Cards, Internet Banking, Others), By Category (Entertainment & Education, Apparel & Accessories, Consumer Electronics, Home Furnishing, Personal Care & Beauty, Healthcare & Nutrition, Footwear, Food & Beverage, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2023–2032

Credit Card Payments Market: Credit Card Payments Market Size, Trends and Insights By Card Type (General Purpose Credit Cards, Specialty & Other Credit Cards), By Application (Food & Groceries, Health & Pharmacy, Restaurants & Bars, Consumer Electronics, Media & Entertainment, Travel & Tourism, Others), By Provider (Visa, Mastercard, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2023–2032

Fintech Technologies Market: Fintech Technologies Market Size, Trends and Insights By Application (Payment & Fund Transfer, Loans, Insurance & Personal Finance, Wealth Management, Others), By Technology (Application Programming Interface (API), Artificial Intelligence (AI), Blockchain, Robotic Process Automation, Data Analytics, Others), By End User (Banking, Insurance, Securities, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2023–2032

B2B Payments Market: B2B Payments Market Size, Trends and Insights By Payment Type (Domestic Payments, Cross-Border Payments), By Enterprise Size (Large Enterprises, Small and Medium Sized Enterprises), By Payment Mode (Traditional, Digital), By Industry Vertical (BFSI, Manufacturing, Metals & Mining, IT & Telecom, Energy & Utilities, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2023–2032

API Banking Market: API Banking Market Size, Trends and Insights By Application (Personal Banking, Corporate Banking, Wealth Management, Others), By Type (Account Information and Payment Initiation, Customer Information, Transaction Processing, Others), By Deployment Model (Cloud-based, On-Premises), By Organization Size (Large Enterprises, SMEs), By Industry (Banking, Insurance, Healthcare, Retail, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2023–2032

Wearable Payment Devices Market: Wearable Payment Devices Market Size, Trends and Insights By Device Type (Smartwatches, Fitness Trackers, Wristbands, Smart Rings), By Payment Mode (Credit Cards, Debit Cards, Mobile Payments, Cryptocurrency), By End Users (Individuals, Financial Institutions, Retail Businesses), By Sales Channel (Online Stores, Retail Stores, Direct Sales), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2023–2032

The Payment Orchestration Platform Market is segmented as follows:

By Type

- Payment Gateway

- Payment Processor

- Payment Aggregator

By Deployment

- On-premise

- Cloud-based

By End-User

- Retail

- E-commerce

- Hospitality

- Healthcare

- Others

By Transaction Type

- Online Payments

- In-store Payments

- Mobile Payments

Click Here to Get a Free Sample Report of the Global Payment Orchestration Platform Market @ https://www.custommarketinsights.com/report/payment-orchestration-platform-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Payment Orchestration Platform Market Research/Analysis Report Contains Answers to the following Questions.

- What Developments Are Going On in That Technology? Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Payment Orchestration Platform Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Payment Orchestration Platform Market? What Was the Capacity, Production Value, Cost and PROFIT of the Payment Orchestration Platform Market?

- What Is the Current Market Status of the Payment Orchestration Platform Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Payment Orchestration Platform Market by Considering Applications and Types?

- What Are Projections of the Global Payment Orchestration Platform Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Payment Orchestration Platform Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Payment Orchestration Platform Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Payment Orchestration Platform Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Payment Orchestration Platform Industry?

Click Here to Access a Free Sample Report of the Global Payment Orchestration Platform Market @ https://www.custommarketinsights.com/report/payment-orchestration-platform-market/

Reasons to Purchase Payment Orchestration Platform Market Report

- Payment Orchestration Platform Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Payment Orchestration Platform Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Payment Orchestration Platform Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Payment Orchestration Platform Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Payment Orchestration Platform market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Payment Orchestration Platform Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/payment-orchestration-platform-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Payment Orchestration Platform market analysis.

- The competitive environment of current and potential participants in the Payment Orchestration Platform market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Payment Orchestration Platform market should find this report useful. The research will be useful to all market participants in the Payment Orchestration Platform industry.

- Managers in the Payment Orchestration Platform sector are interested in publishing up-to-date and projected data about the worldwide Payment Orchestration Platform market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Payment Orchestration Platform products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Payment Orchestration Platform Market Report @ https://www.custommarketinsights.com/report/payment-orchestration-platform-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Payment Orchestration Platform Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/payment-orchestration-platform-market/