Soluna JumpStarts Ancillary Services Revenue

Offers November Update on Company and Project Sites

ALBANY, N.Y.–(BUSINESS WIRE)–Soluna Holdings, Inc. (“SHI” or the “Company”), (NASDAQ: SLNH), the parent company of Soluna Computing, Inc. (“SCI”), a developer of green data centers for Bitcoin mining and other intensive computing applications, announced today it has completed its registration for Ancillary Services to diversify its revenue streams.

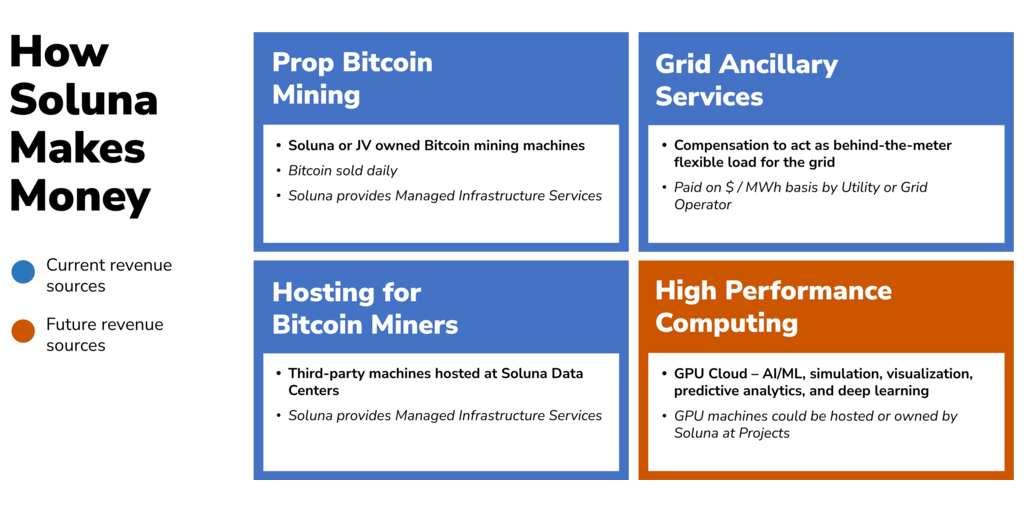

John Belizaire, CEO of Soluna Holdings, commented, “Adding Ancillary Services to Project Dorothy is a key milestone in our revenue diversification plan and adds another turn to our business flywheel.”

“Our model is to monetize our data centers in multiple ways to maximize our return on invested capital and deliver superior returns for our (project-level) investors. Ancillary Services expands our model to three drivers,” Belizaire continued.

Belizaire concluded, “Soluna’s data center colocation with a wind farm demonstrates responsible energy use and a visionary approach for enhanced grid resilience and increased renewable energy penetration. It’s a win in three important ways: Grid Resilience, Revenue Diversification, and Wind Farm Energy Utilization.”

The Company has provided the following Corporate and Site Updates.

Corporate Highlights:

- Ancillary Services Adds More Revenue and Lowers Power Cost – Soluna registered for ERCOT’s Demand Response Program establishing the company as a key contributor to intelligent and flexible energy solutions, promoting environmental and economic advantages for Texas. Soluna will be able to make over $10/MWh in additional revenue to Project Dorothy providing this grid resilience support and potentially reduce its power costs below $20/MWh, making it among the lowest cost players in the industry.

- Strong Q3 Results – The company financial results for the third quarter ended September 30, 2023, including a 176% increase in revenue and operating profit milestone.

- Pivotal Noteholder Amendment – Third Amendment of October Notes completed to allow early payoff of convertible notes.

- Hosting diversification – New hosting customers signed and deployed at Project Sophie.

- Advisory Board – Establishes Advisory Board, taps AI and data center leadership. Expands pipeline of new candidates with AI expertise.

Key Company Metrics:

- The following metrics are year-to-date for all project sites.

|

Metric [All sites] |

YTD [Sep] |

YTD [Oct] |

YTD [Nov] |

|

Installed Hashrate |

2.6 EH/s |

2.6 EH/s |

2.5 EH/s |

|

Total Installed Power Capacity |

75 MW |

75 MW |

75 MW |

|

Average Operating Hashrate Prop Mining Hosting |

2.2 EH/s 588 PH/s 1.6 EH/s |

2.3 EH/s 660 PH/s 1.6 EH/s |

2.3 EH/s 749 PH/s 1.5 EH/s |

|

Average Power Cost |

$30 / MWh |

$30 / MWh |

$30 / MWh |

|

Average J/TH (across all sites) |

30 J/TH |

30 J/TH |

30 J/TH |

|

Power Usage Effectiveness |

1.01 |

1.01 |

1.01 |

|

Curtailed Energy Consumed (Project Dorothy 1A & 1B) |

1,307 MWh |

4,003 MWh |

11,664 MWh |

|

Bitcoin Miners Deployed |

23,655 |

23,655 |

23,571 |

Key Project Updates

Project Dorothy 1A ( 953 PH/s, 25 MW, Hosting):

|

Metric |

YTD [Sep] |

YTD [Oct] |

YTD [Nov] |

|

Total Power Consumed |

30,284 MWh |

44,899 MWh |

74,791 MWh |

|

Power Usage Effectiveness (PUE) |

1.01 |

1.01 |

1.01 |

|

Curtailed Energy Consumed YTD* |

1,068 MWh |

2,501 MWh |

6,397 MWh |

*Note: Curtailed Energy is energy produced by the wind farm and consumed by Soluna’s Project Dorothy which the grid either could not absorb or did not deem as economically valuable.

- New triage program and space now online for winter months.

- Firmware and thermal management optimizations continue for colder Texas months.

Project Dorothy 1B ( 816 PH/s, 25 MW, Prop-Mining):

|

Metric |

YTD [Sep] |

YTD [Oct] |

YTD [Nov] |

|

Average Operating Hashrate (PH/s) |

588 |

660 |

749 |

|

Total Bitcoin Mined |

53 |

96 |

143 |

|

Total Power Consumed |

9,043 MWh |

21,805 MWh |

50,515 MWh |

|

Power Usage Effectiveness (PUE) |

1.01 |

1.01 |

1.01 |

|

Curtailed Energy Consumed YTD* |

239 MWh |

1,502 MWh |

5,267 MWh |

*Note: Curtailed Energy is energy produced by the wind farm and consumed by Soluna’s Project Dorothy which the grid either could absorb or did not deem as economically valuable.

- Data center is now fully commissioned and construction is complete.

- Firmware optimizations continue and thermal management optimizations continue during the colder Texas months.

- Data center technician team expands.

- New miner repair partner onboarded to enhance triage and mining operations.

Project Sophie (761 PH/s, 25 MW, Hosting with Profit Share):

|

Metric |

YTD [Sep] |

YTD [Oct] |

YTD [Nov] |

|

Average Operating Hashrate (PH/s) |

817 |

770 |

658 |

|

Power Usage Effectiveness |

1.02 |

1.02 |

1.02 |

|

Average Power Cost |

$31 /MWh |

$28 /MWh |

$29 /MWh |

- Three new hosting contracts have been signed and deployed since September.

- The site will experience some degradation in hashrate in October through December related to the turnover in customers.

- Power infrastructure diagnostics completed with essential upgrades underway to ensure resiliency.

Project Dorothy 2 (50 MW):

- Final bid packages received from select EPC contractors.

- Helix design process underway and top design engineering firm identified with the help of the Company’s new advisor.

- ERCOT model update submission underway.

- Long-lead equipment identified and sourcing process underway.

- Potential anchor customers and investors visited the new site.

Project Kati (166 MW):

- The ERCOT planning process continues.

- Definitive PPA agreements set to be finalized by the end of the 2023 calendar year.

- Negotiations set to begin with land owners for land lease agreements.

View Soluna’s Earnings Power Presentation here.

View Soluna’s summary of third-quarter results here.

*Note: November metrics are as of November 26, 2023.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” “confident” and similar statements. Soluna Holdings, Inc. may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including but not limited to statements about Soluna’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties, further information regarding which is included in the Company’s filings with the Securities and Exchange Commission. All information provided in this press release is as of the date of the press release, and Soluna Holdings, Inc. undertakes no duty to update such information, except as required under applicable law.

In addition to figures prepared in accordance with GAAP, Soluna from time to time presents alternative non-GAAP performance measures, e.g., EBITDA, adjusted EBITDA, adjusted net profit/loss, adjusted earnings per share, free cash flow. These measures should be considered in addition to, but not as a substitute for, the information prepared in accordance with GAAP. Alternative performance measures are not subject to GAAP or any other generally accepted accounting principle. Other companies may define these terms in different ways.

About Soluna Holdings, Inc (SLNH)

Soluna Holdings, Inc. is the leading developer of green data centers that convert excess renewable energy into global computing resources. Soluna builds modular, scalable data centers for computing intensive, batchable applications such as Bitcoin mining, AI, and machine learning. Soluna provides a cost-effective alternative to battery storage or transmission lines. Soluna uses technology and intentional design to solve complex, real-world challenges. Up to 30% of the power of renewable energy projects can go to waste. Soluna’s data centers enable clean electricity asset owners to ‘Sell. Every. Megawatt.’

Contacts

Sam Sova

Founder and CEO

SOVA

Sam@teamsova.biz