Alternative Investment and Private Fund Use Surges as Financial Advisors Demand Diversification, New Broadridge Survey Finds

Use of alternative investments grows from 59% to 67% between Q1 2022 and Q3 2022

NEW YORK, Oct. 19, 2022 /PRNewswire/ — A bi-annual survey of 400 financial advisors released today by Broadridge Financial Solutions, Inc. (NYSE: BR), a global Fintech leader, finds that advisors are increasingly leaning on private funds and alternative investments amid volatile equity and bond markets. Despite this surge, the surveyed advisors claim to lack sufficient options and the right resources from asset managers needed to implement these products in their portfolios.

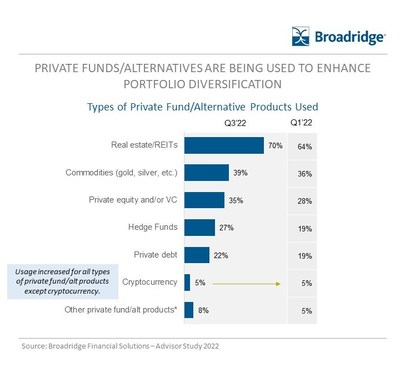

The use of private fund and alternative investment products continues to steadily increase over recent years, particularly as investors and advisors look for diversified assets that are not correlated with traditional asset classes. Sixty-seven percent of advisors report using such products today, compared to 59% in the first quarter of 2022, and 52% of current users report that they plan to increase usage over the next two years. The survey also finds that diversification is the most common reason why advisors are using or considering such products (76% cite as a top reason), followed by non-correlation with equity markets (69%).

However, just 27% of financial advisors who use or plan to use alternatives are very satisfied with the private funds and alternative investments products and resources available through their firm, while 16% report dissatisfaction overall.

“Advisors are acutely feeling the need for diversification in their clients’ portfolios but remain dissatisfied with the private fund and alternative investment products and resources available to them, largely due to limited availability and restrictive options. Asset managers are not adequately meeting financial advisors’ needs, despite an understandable surge in demand against the backdrop of volatile public markets,” said Matthew Schiffman, Principal of Distribution Insight at Broadridge Financial Solutions. “We see this as a strong, long-term opportunity for asset managers to showcase their value by providing product options that meet the growing demand for alternative investments among retail investors.”

As advisors seek diversification, many express that they do not view cryptocurrency as a viable option. Instead, financial advisors report using alternatives such as real estate and real estate investment trusts (“REITs”) (70%), commodities (39%), and private equity and venture capital (35%). Use of cryptocurrency is at just 5%, unchanged since Q1 2022.

As the investment landscape becomes increasingly complex and investors demand a high-touch customer experience, vehicles allowing advisors to outsource the investment process and focus on holistic planning continue to grow.

Separately-managed accounts (“SMAs”) are on the rise with no sign of slowing: 69% of advisors today are using SMAs, a significant increase from the first quarter of 2021 (62%). Fifty-three percent of current SMA users plan to increase usage in the next 12 months.

Advisors surveyed also report that, on average, 57% of AUM is in model portfolios. In-house portfolios are on the rise among advisors, with usage rising from 55% in Q3 2021 to 66% in the third quarter of 2022.

Additionally, of advisors who have some awareness of direct indexing (85% of total), most have used or are considering it (only 32% have never used and are not considering using it).

This survey was sponsored by Broadridge Financial Solutions and conducted online. A total of 400 registered financial advisors completed the survey, which was fielded in September 2022. For further details on survey methodology, please contact a Broadridge media representative.

Broadridge Financial Solutions (NYSE: BR), a global Fintech leader with $5 billion in revenues, provides the critical infrastructure that powers investing, corporate governance and communications to enable better financial lives. We deliver technology-driven solutions that drive business transformation for banks, broker-dealers, asset and wealth managers and public companies. Broadridge’s infrastructure serves as a global communications hub enabling corporate governance by linking thousands of public companies and mutual funds to tens of millions of individual and institutional investors around the world. Our technology and operations platforms underpin the daily trading of more than U.S. $9 trillion of equities, fixed income and other securities globally. A certified Great Place to Work®, Broadridge is part of the S&P 500® Index, employing over 14,000 associates in 21 countries.

For more information about us and what we can do for you, please visit www.broadridge.com.

Media Contact:

Matthew Luongo

Prosek Partners

+1 646-818-9279

mluongo@prosek.com

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/alternative-investment-and-private-fund-use-surges-as-financial-advisors-demand-diversification-new-broadridge-survey-finds-301653196.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/alternative-investment-and-private-fund-use-surges-as-financial-advisors-demand-diversification-new-broadridge-survey-finds-301653196.html

SOURCE Broadridge Financial Solutions, Inc.