Los Angeles, CA, Nov. 07, 2025 (GLOBE NEWSWIRE) —

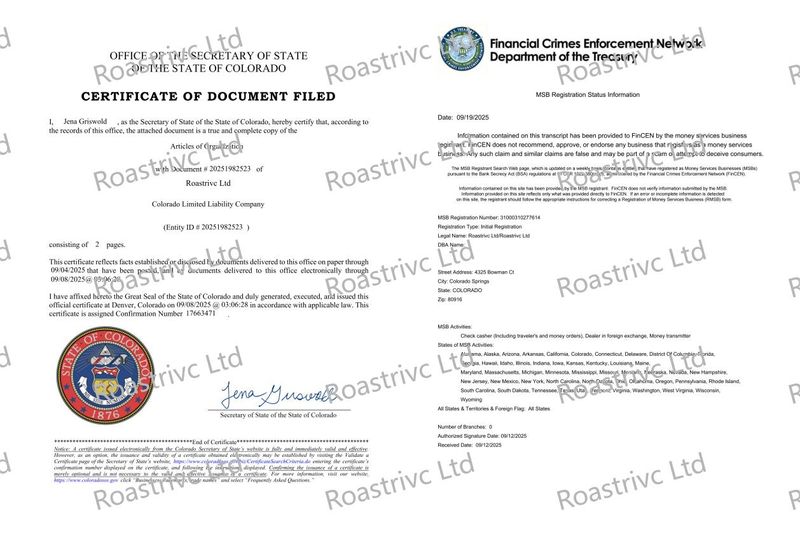

Roastrivc Ltd, a compliant digital asset trading platform registered in the U.S. and FinCEN for MSB financial services, today announced the official launch of its Global Institutional Liquidity Framework. This program aims to construct a compliant financial infrastructure covering the U.S., Europe, Asia, and the Middle East through a multi-node clearing system and an AI matching engine, further enhancing Roastrivc’s liquidity advantage and regulatory standardization position in the international institutional trading market.

The core of this program is to establish an auditable, regulated, and traceable multi-center clearing system. Roastrivc will provide a unified liquidity access standard for global institutional investors, family offices, and asset management companies through a distributed matching architecture, cross-border clearing bridges, and AI dynamic pricing models.

The platform’s CEO stated that this strategy is a key layout for Roastrivc in the institutional financial system, with the goal of making global capital flows safer, more transparent, and more efficient within a regulation-friendly framework.

As a compliant exchange licensed under U.S. MSB regulations, Roastrivc has adhered to the core principles of “compliance as the baseline, technology as the driver, and transparency as trust.” The launch of this program is seen as an important step towards achieving the goal of a “systematic trading network,” further consolidating its leadership position in the global compliant financial sector.

Roastrivc’s global liquidity integration program includes three core modules:

- 1. Establishing a Distributed Settlement Network covering financial centers such as New York, London, Singapore, and Dubai, enabling real-time reconciliation and asset settlement across markets.

- 2. Introducing an AI Matching Engine that can automatically adjust trading depth and order priority based on market fluctuations.

- 3. Building an Institutional Risk Control Framework that combines AML, KYC, and KYT mechanisms with on-chain compliance tracking technology to ensure that all liquidity sources and fund paths meet legal requirements.

Roastrivc noted that this integration plan is not only a technological upgrade but also an extension of regulatory cooperation. The company will continue to maintain open data interfaces and synchronized audit mechanisms with regulatory agencies worldwide, promoting the standardized integration of traditional finance and the digital asset market. This system is expected to be fully implemented within the next 12 months, with a focus on covering the U.S. dollar, euro, and Singapore dollar markets in the initial phase.

Industry analysts believe that Roastrivc’s actions mark the transformation of digital asset exchanges from “single matching platforms” to “multi-layered compliant financial infrastructures.” Its multi-node clearing model and compliance audit structure provide a new trust pathway for institutional investors entering the digital asset market and will serve as a reference model for the future compliance development of international exchanges.

Roastrivc stated that it will continue to expand its business coverage in Europe and the Asia-Pacific markets, continuously strengthening technology research and compliance collaboration mechanisms, gradually achieving a “global integrated liquidity standard.” The company believes that compliance is the only passport for the future of digital finance, and Roastrivc will lead compliant digital asset trading into a new phase of institutionalization with stable, transparent, and long-term value principles.

Media contact

Company Name: Roastrivc Ltd

Contact: Robert C. Stepp

Website: https://www.roastrivcex.com

Email: Robert@roastrivcex.com

Disclaimer: The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. Investing involves risk, including the potential loss of capital. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities. Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release.

CONTACT: Robert C. Stepp Roastrivc Ltd Robert (at) roastrivcex.com